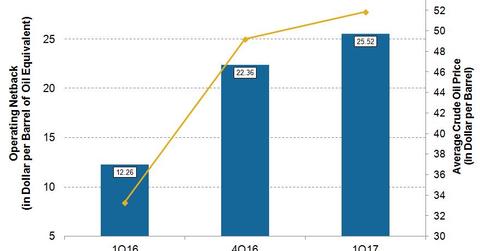

Chart in Focus: ConocoPhillips’s Operating Netback

What is the operating netback? The operating netback (also referred as production netback) is oil and gas revenue realized per boe (barrel of oil equivalent) after all costs to bring one boe to the market are subtracted from the realized price. The operating netback is derived by subtracting production expenses (or field operating expenses), production taxes, […]

July 5 2017, Updated 10:36 a.m. ET

What is the operating netback?

The operating netback (also referred as production netback) is oil and gas revenue realized per boe (barrel of oil equivalent) after all costs to bring one boe to the market are subtracted from the realized price. The operating netback is derived by subtracting production expenses (or field operating expenses), production taxes, and transportation expenses from the realized price including hedging benefits.

ConocoPhillips’s operating netback

In 1Q17, ConocoPhillips (COP) reported an operating netback of ~$25.52 per boe, which is ~108% higher than its netback in 1Q16. The higher netback in 1Q17 can be attributed to the significant rise in crude oil (USO), natural gas (UNG), and natural gas liquid prices in the last year.