Could Rising Industrial Production Boost India’s Market Performance?

Recently, the Indian government revised the base year for calculating macroeconomic indicators from 2004–2005 to 2011–2012.

May 23 2017, Published 3:53 p.m. ET

Industrial production on the rise in India

Recently, the Indian government revised the base year for calculating macroeconomic indicators from 2004–2005 to 2011–2012. According to a new base year of 2011–2012 for calculating key macroeconomic indicators, industrial production grew in March 2017.

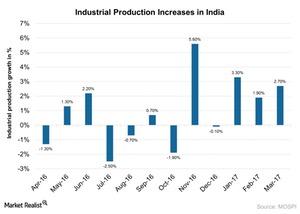

The new series in the industrial production index continues to cover three sectors: mining, manufacturing, and electricity. Let’s look at India’s industrial production over the last year in the chart below:

Industrial production in India

Industrial output in India (INP) (INDL) rose 2.7% on a year-over-year basis in March 2017, compared to an upward revision of 1.9% in the previous month. This increase beat market expectations. This output increased for both sectors for March 2017:

- Mining grew 9.7% compared to 4.6% in February.

- Electricity rose 6.2% compared to 1.2% in the previous month.

- Manufacturing production improved at a slower pace of ~1.2% compared to 1.4% in the previous month.

The country’s industrial output increased 5% in 2016–2017 in India (PIN) (INDY). Industrial production in India averaged ~6.1% from 1994–2017. The Make in India initiative launched by the government of India seems to be helping the cause and could help the performance manufacturing sector going forward.

Industrial output to drive growth

The economic data on industrial production helps clarify the economic backdrop for the markets, and it’s crucial for investors to keep tabs on this data. Industrial production is input in estimating gross value added to the national output of the unorganized manufacturing sector in India.

An improved industrial output could mean healthy economic growth, translating into higher overall corporate profits (SCIF) (SCIN).

Investment impact

The iShares S&P India Nifty 50 Index ETF (INDY), which tracks 50 of the largest Indian equities, has gained about 18% year-to-date through May 18, 2017.

Another similar index is the PowerShares India Portfolio ETF (PIN). PIN is based on the Indus India Index, which tracks a group of 50 Indian stocks. The PowerShares India Portfolio ETF (PIN) gained ~20% during the same period.

In the final article of this series, let’s look at the inflationary trend in India.