Here’s What’s Driving Medtronic’s MITG Segment

Of Medtronic’s ~$7.3 billion in worldwide revenues in fiscal 2Q17, ~$2.5 billion came from Medtronic’s MITG segment, representing ~34% of the company’s total revenues.

Nov. 29 2016, Updated 8:05 a.m. ET

MITG segment: 2Q17 performance

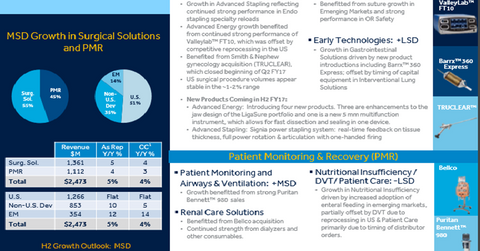

Medtronic (MDT) reported ~$7.3 billion in worldwide revenues in fiscal 2Q17. Of that total, ~$2.5 billion came from Medtronic’s MITG (Minimally Invasive Therapies Group) segment, representing ~34% of the company’s total revenues. These sales figures represent a ~4% YoY (year-over-year) rise in fiscal 2Q17 on constant currency basis, which is in line with Medtronic’s expectation of mid-single-digit revenue growth for MITG.

In 2Q17, MITG sales growth in the United States was flat. However, Medtronic noted strong MITG segment sales of ~10% and 12% in non-US developed markets and emerging markets, respectively, YoY. The segment’s surgical solutions business grew ~5%, whereas the PMR (Patient Monitoring and Recovery) grew 4%. (For MITG a more on this business, check out Market Realist’s “Medtronic’s Minimally Invasive Therapies Group: Major Drivers.”)

Medtronic’s major competitors in the minimally invasive therapies market include Intuitive Surgical (ISRG), Johnson & Johnson (JNJ), and Smith & Nephew (SNN), which reported YoY sales growth of 15.8%, 4.2%, and 1.3%, respectively, in their most recent quarters. Notably, the iShares S&P 500 Growth ETF (IVW) invests approximately 0.61% of its total holdings in MDT.

Growth drivers

The MITG segment registered strong growth that was in line with the company’s expectations for fiscal 2Q17. The primary growth drivers for the segment were Open-to-MIS (minimally invasive surgery), the recent acquisition of Smith & Nephew’s gynecology business (see “Why Medtronic Acquired Smith & Nephew’s Gynecology Business“) and strong sales contributions from emerging markets. Medtronic’s recently launched Valleylab FT10 energy platform and growth in advanced stapling contributed strongly to advanced surgical growth.

The segment’s surgical solutions business, however, reported weaker-than-expected growth due to the competitive reprocessing of the disposables in the United States.

Some of the major products that benefitted Medtronic’s growth in the quarter 2Q17 include the recently launched Valleylab FT10 and Barrx 360 Express, Truclear, and Bellco. Four new products are expected to be launched in the second half of fiscal 2017, which will help augment the growth of MITG segment.

Next, we’ll look at Medtronic’s Restorative Therapies Group performance in fiscal 2Q17.