Smith & Nephew PLC

Latest Smith & Nephew PLC News and Updates

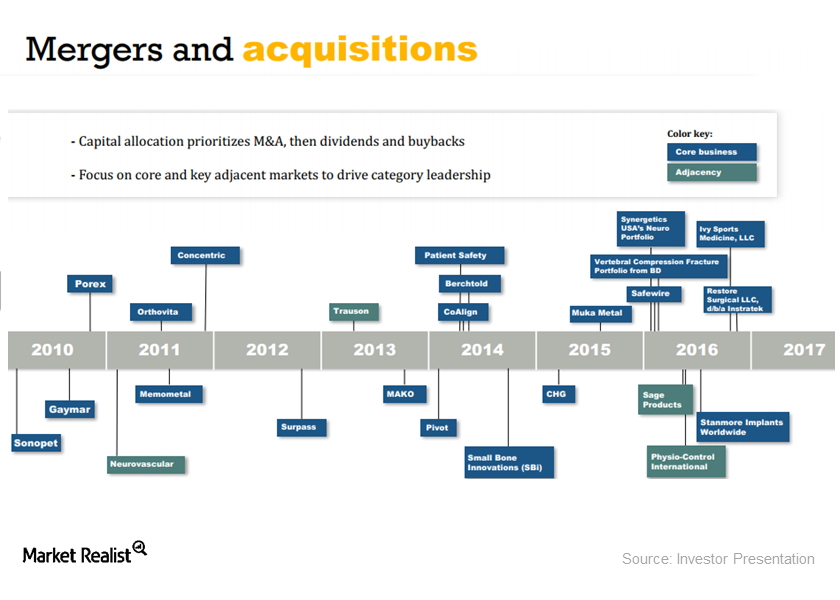

Stryker’s Inorganic Growth Strategy Continues to Boost Growth

Stryker’s acquisition-driven growth strategy Stryker (SYK) has been growing at a fast pace through inorganic growth. It has undertaken a number of strategic acquisitions recently. In 3Q17, acquisitions contributed approximately 0.6% of the company’s YoY (year-over-year) sales growth, and in the first three quarters of 2017, Stryker acquisitions contributed ~3.2% of the company’s sales growth […]

Asia-Pacific Still Zimmer Biomet’s Strongest Geography

Zimmer Biomet Holdings witnessed a strong performance in its Asia-Pacific region. It contributed 16% to the company’s total sales.

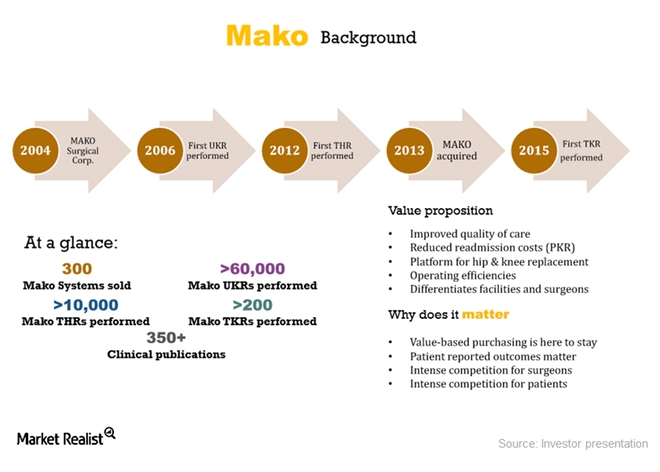

How Mako Robots Are Driving Stryker’s Sales in 2017

Mako sales in 3Q17 In 3Q17, Stryker sold 33 Mako robots, compared with 30 robots in 3Q16. In 2Q17, Stryker installed 26 Mako robots. Of these 33 robots, 23 were installed in the United States. Around 40% of US sales are expected to be in competitive accounts. Stryker is training surgeons on its total knee application […]

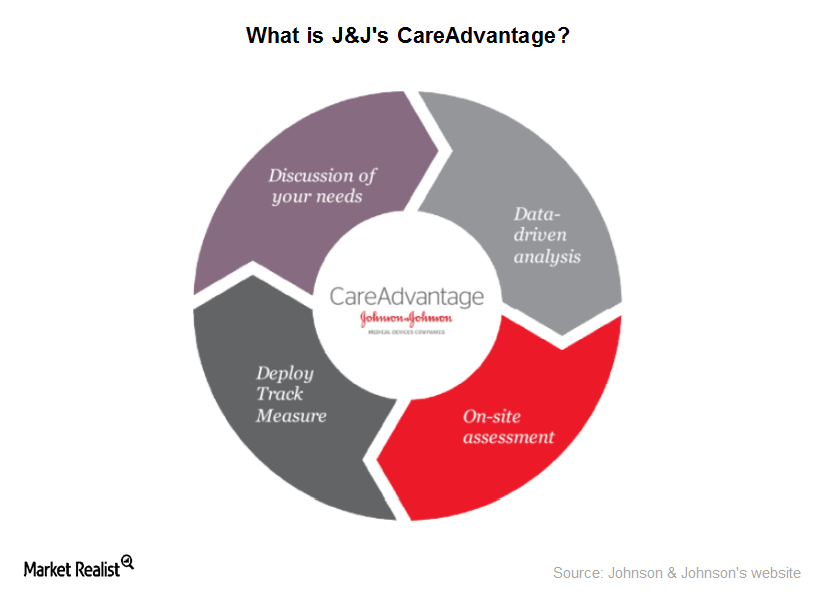

Inside the Latest Capability Advancement in Johnson & Johnson’s Orthopedics

On January 9, JNJ’s Medical Device division announced its Orthopedic Episode of Care Approach, a data-driven program that will accelerate value-based care.

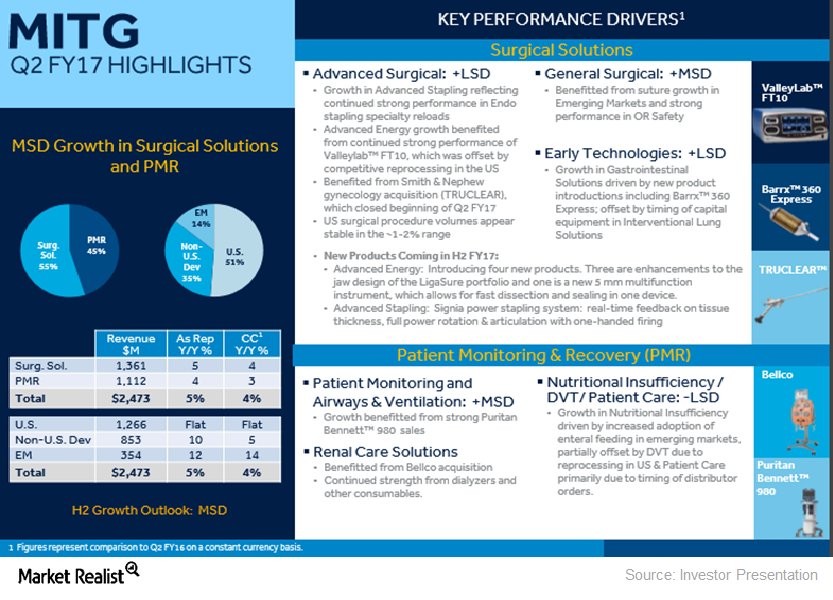

Here’s What’s Driving Medtronic’s MITG Segment

Of Medtronic’s ~$7.3 billion in worldwide revenues in fiscal 2Q17, ~$2.5 billion came from Medtronic’s MITG segment, representing ~34% of the company’s total revenues.

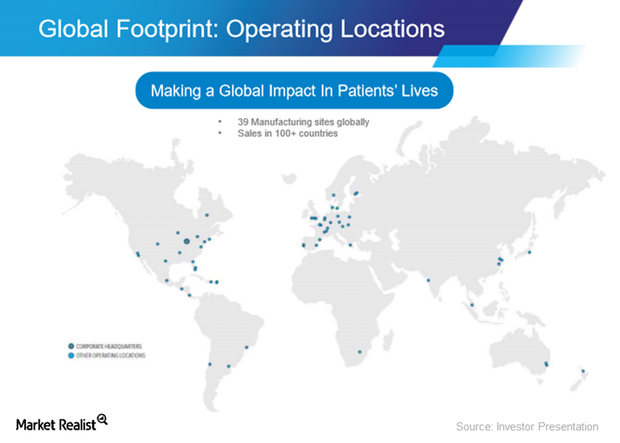

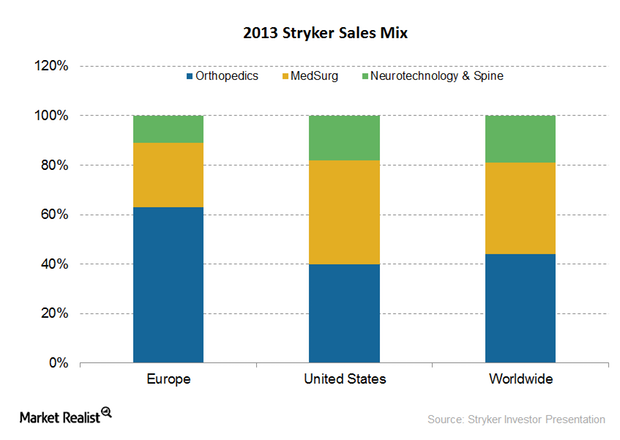

How Stryker Plans to Leverage the Under-Tapped Europe Opportunity

Europe represents a potential growth opportunity for Stryker, as the company currently has a low market share in Europe compared to other developed markets.

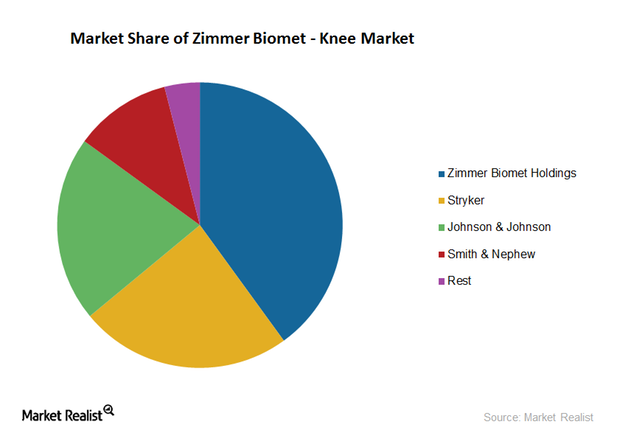

Zimmer Biomet Faces Market Share Erosion in the Knee Implant Market

Zimmer Biomet (ZBH) is the leading provider of knee implants in the United States. It has approximately 40% market share, followed by Stryker, Johnson & Johnson, and Smith & Nephew.