Understanding Devon Energy’s Production Volumes

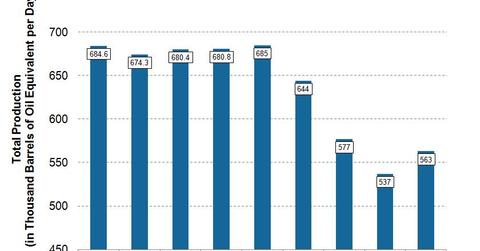

For 1Q17, Devon Energy (DVN) reported total production of 563 MBoepd, which is ~18% lower when compared with 1Q16.

May 22 2017, Updated 7:39 a.m. ET

Devon Energy’s production in 1Q17

For 1Q17, Devon Energy (DVN) reported total production (USO) (UNG) of 563 MBoepd (thousand barrels of oil equivalent per day), which is ~18% lower when compared with 1Q16. However, on a sequential basis, Devon Energy’s 1Q17 production is ~5% higher when compared with 4Q16.

Devon Energy’s production trend

Devon Energy’s total quarter-over-quarter production volumes have been stagnated since 2Q14 and averaged ~678 Mboepd. In 2Q16, DVN’s production started to decline. DVN’s production fell to the lowest level of ~537 Mboepd in 4Q16. This steep decline in production volumes can be attributed to Devon Energy’s non-core asset divestitures program.

According to Devon Energy’s 1Q17 operations report, the company’s 1Q17 production was mainly driven by its US core assets. DVN’s US core assets reported production of ~422 MBoepd, which is ~12% lower when compared with 1Q16. Within DVN’s US core assets, its Barnett Shale assets reported the highest production of ~158 Mboepd.

Among the other upstream companies, Marathon Oil (MRO) reported an ~2% year-over-year (or YoY) decrease in its 1Q17 production, and ConocoPhillips (COP) reported an ~0.4% YoY increase in its 1Q17 production.

The Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 3x Shares ETF (GUSH) is a leveraged ETF that invests in oil and gas exploration and production companies. The Energy Select Sector SPDR ETF (XLE) generally invests at least 95% of its total assets in oil and gas companies.

Devon Energy’s production guidance

- For 2Q17, DVN expects total production volume in the range of 519–540 Mboepd.

- For fiscal 2017, DVN expects total production volume in the range of 539–561 Mboepd.

In the next part, we’ll look into Devon Energy’s production mix for 1Q17.