Reading the Mining Stocks’ Falling RSI Numbers

Newmont Mining, Silver Wheaton, Randgold, and Yamana have RSI levels of 45.5, 37.1, 41.2, and 43.0, respectively.

May 2 2017, Updated 9:11 a.m. ET

Precious metal funds

As investors analyze which mining shares are most closely linked to gold and which are not, it’s also important that they view the essential technicals of the miners in which they want to invest. Specifically, leveraged mining funds such as the iDirexion Daily Gold Miners ETF (NUGT) and the Proshares Ultra Silver ETF (AGQ) saw substantial rises at the beginning of 2017 due to the revival in precious metals.

However, during the past week, these two funds slumped 17.4% and 8.1%, respectively, due to the drop in precious metals.

Implied volatility

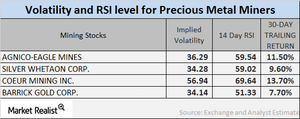

Call-implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option. During times of global and economic turbulence, volatility is higher than during a stagnant economy.

On April 28, 2017, the volatilities of Newmont Mining (NEM), Silver Wheaton (SLW), Randgold Resources (GOLD), and Yamana Gold (AUY) were 27.6%, 34.2%, 30.6%, and 47.0%, respectively. A mining company’s volatility is often higher than a precious metal’s volatility.

RSI levels

A 14-day RSI above 70 indicates the possibility of downward movement in a stock’s price, whereas a level below 30 shows the possibility of upward movement in a stock’s price. The RSI levels of the four mining giants mentioned above have all risen due to higher stock prices.

Specifically, Newmont Mining, Silver Wheaton, Randgold, and Yamana Gold have RSI levels of 45.5, 37.1, 41.2, and 43.0, respectively. With the falling prices of these mining stocks, the RSI levels of these respective stocks have fallen. Significantly low RSI numbers suggest a possible rise in price.