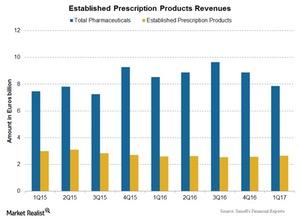

Performance of Sanofi’s Established Prescription Products in 1Q17

Revenues from Sanofi’s Established Prescription Products rose 0.6% at constant exchange rates during 1Q17 and reported revenues of ~2.6 billion euros in 1Q17.

May 29 2017, Updated 9:06 a.m. ET

Established Prescription Products franchise

Sanofi’s (SNY) Established Prescription Products contributed over 30% of the company’s total revenues for 1Q17. Revenues from Established Prescription Products rose 0.6% at constant exchange rates during 1Q17 and reported revenues of ~2.6 billion euros in 1Q17.

The growth was driven by strong performance of the drugs Lovenox, Renagel/Renvela, Aprovel, and Depakine, but it was substantially offset by lower sales of Plavix, Allegra, and several other drugs.

Plavix

Plavix is an anticoagulant used to prevent blood clots. Plavix revenues have decreased over the last few quarters following the loss of market share to competition from AstraZeneca’s (AZN) Brilianta, Eli Lilly & Co.’s (LLY) Effient, and Johnson & Johnson’s (JNJ) Xarelto. Plavix revenues fell 1.8% at constant exchange rates to 380 million euros during 1Q17.

Renagel/Renvela

Renagel and Renvela are used to control serum phosphorus in patients with chronic kidney disease and who are on dialysis. These drugs reported revenue growth of 2.1% at constant exchange rates to 246 million euros during 1Q17. The growth was offset by lower sales in the European markets due to generic competition.

Lovenox

Lovenox is another anticoagulant used to prevent blood clots. The drug reported revenue growth of 2.2% at constant exchange rates to 415 million euros during 1Q17 due to the strong performance in global markets, with the exception of the US and European markets. The drug is exposed to generic competition in the US markets and potential biosimilars in the European markets.

Other drugs from this franchise include Aprovel, Allegra, Myslee, Synvisc, Tritace, Lasix, Targocid, and other prescription products.

To divest any company-specific risk, investors can consider the PowerShares International Dividend Achievers ETF (PID), which holds 1.9% of its total assets in Sanofi.