A Look at Sanofi Pasteur’s Performance in 2Q17

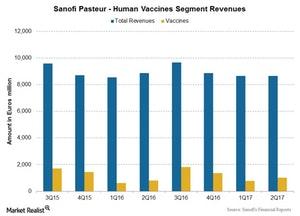

Sanofi Pasteur Sanofi Pasteur, Sanofi’s (SNY) human vaccine business, reported 26.2% revenue growth at constant exchange rates to 1.0 billion euros in 2Q17. Sanofi Pasteur reported growth across all product franchises during the quarter. Sanofi Pasteur includes polio/pertussis/Hib (haemophilus influenzae type b) vaccines, adult booster vaccines, meningitis vaccines, influenza vaccines, travel and other endemic vaccines, […]

Aug. 18 2017, Updated 10:37 a.m. ET

Sanofi Pasteur

Sanofi Pasteur, Sanofi’s (SNY) human vaccine business, reported 26.2% revenue growth at constant exchange rates to 1.0 billion euros in 2Q17. Sanofi Pasteur reported growth across all product franchises during the quarter.

Sanofi Pasteur includes polio/pertussis/Hib (haemophilus influenzae type b) vaccines, adult booster vaccines, meningitis vaccines, influenza vaccines, travel and other endemic vaccines, and dengue vaccines.

Polio/pertussis/Hib vaccines

In 2Q17, polio/pertussis/Hib vaccines Pentacel, Pentaxim, and Imovax generated revenue of 469 million euros, a 37.2% rise from 2Q16, following strong sales in the United States, Europe, emerging markets, and the rest of the world.

Adult and booster vaccines

Adult booster vaccines generated revenue of 115 million euros in 2Q17, representing 11.5% growth from 2Q16. The growth was driven by strong performance in European markets, and substantially offset by lower sales in US markets, emerging markets, and the rest of the world.

Meningitis and pneumonia vaccines

Meningitis and pneumonia vaccines generated revenue of 195 million euros, representing 38.1% growth from 2Q16. The growth was driven by strong performance in US markets, emerging markets, and the rest of the world, and substantially offset by lower sales in European markets.

Influenza vaccines

Influenza vaccines Vaxigrip and Fluzone generated flat revenue of 98 million euros in 2Q17. Revenue was driven by strong performance in emerging markets and partially offset by lower sales in the rest of the world.

Travel and other endemic vaccines

Travel and other endemic vaccines reported revenue growth of 10.9% to 113 million euros in 2Q17, boosted by strong performance in European markets and offset by lower sales in US and emerging markets.

Dengue vaccines

Dengue vaccines generated revenue of 1 million euros during 2Q17. The termination of Sanofi’s European vaccines joint venture with Merck and Co. (MRK) on December 31, 2016, boosted Sanofi’s vaccine business in 2Q17.

To divest company-specific risks, investors could consider the PowerShares International Dividend ETF (PID), which has a 1.4% exposure to Sanofi (SNY). PID also has a 1.5% exposure to Novartis (NVS), a 1.0% exposure to Teva Pharmaceutical Industries (TEVA), and a 1.1% exposure to Novo Nordisk (NVO).