Mining Stocks Are Recovering from Their Slump

The Direxion Daily Gold Miners (NUGT) and the ProShares Ultra Silver (AGQ), both leveraged mining funds, both have recovered and jumped 19.4% and 24.9%, respectively, on a five-day trailing basis.

Nov. 20 2020, Updated 11:13 a.m. ET

Mining stock technicals

Precious metals have witnessed a rebound in their price. While there are many important indicators that an analyst can monitor, we’ll focus on 14-day RSI (relative strength index) scores and implied volatility.

Among the precious metal mining funds, the Direxion Daily Gold Miners (NUGT) and the ProShares Ultra Silver (AGQ), both leveraged mining funds, have recovered and jumped 19.4% and 24.9%, respectively, on a five-day trailing basis. Most of the time, the volatility of mining funds, especially leveraged ones is higher than that of metal-based funds.

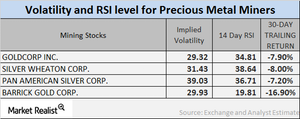

As shown in the chart above, mining stocks have seen significant trailing-30-day declines in prices due to the fall in precious metal prices.

Implied volatility

Call implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option. During times of global and economic turbulence, volatility typically rises.

On May 4, 2017, the implied volatilities of Goldcorp (GG), Silver Wheaton (SLW), Pan American Silver (PAAS), and Barrick Gold (ABX) stood at 29.3%, 31.4%, 39%, and 29.9%, respectively. Notably, mining companies’ volatilities are often higher than precious metals’ volatilities.

RSI scores

A 14-day RSI score above 70 suggests that a stock price may fall, whereas a score below 30 suggests that a stock price may rise. The RSI levels of the four mining giants mentioned above have all increased due to their higher stock prices.

Goldcorp, Silver Wheaton, Pan American, and Barrick have RSI scores of 34.8, 38.6, 36.7, and 19.8, respectively. Notably, these RSI scores have fallen along with the respective companies’ stock prices. Such terribly low RSI levels suggest a pullback in prices soon.

For ongoing updates on this industry, keep checking in with Market Realist’s Metals and Mining page.