What Do Analysts Expect from Merck’s 1Q17 Earnings?

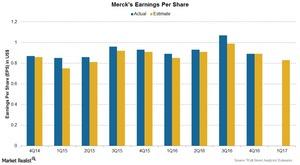

Merck and Co. (MRK) will release its 1Q17 earnings on May 2, 2017. Analysts’ estimates show EPS of $0.83 on revenues of $9.25 billion for 1Q17.

May 1 2017, Published 10:29 a.m. ET

Merck’s 1Q17 estimates

Merck and Co. (MRK) is one of the oldest and largest pharmaceutical companies in terms of revenues. Merck and Co. will release its 1Q17 earnings on May 2, 2017. Analysts’ estimates show EPS (earnings per share) of $0.83 on revenues of $9.25 billion for 1Q17.

The above chart shows a comparison between analysts’ estimates and Merck’s actual EPS over the last few quarters.

1Q17 revenues

Merck’s revenues are estimated to fall ~0.7% to $9.25 billion for 1Q17—compared to revenues of $9.31 billion for 1Q16. Analysts expect that the operational increase in revenues will be substantially offset by the negative impact of foreign exchange. The major growth contributors during 1Q17 are expected to include key drugs like Gardasil, Januvia, Janumet, and Keytruda.

Profitability estimates

Analysts’ estimates show a gross profit margin of 75.8% for 1Q17—a 1.2% decrease compared to the gross profit margin in 1Q16. Due to the increase in research and development expenses as well as higher selling, general and administrative expenses as a percentage of total revenues, the EBITDA margin is expected to fall to 49.2% in 1Q17—compared to 52.1% in 1Q16. The net adjusted income is expected to fall to ~$2.31 billion in 1Q17.

To divest the risk, investors can also consider ETFs like the Fidelity MSCI Health Care ETF (FHLC). FHLC holds 5.3% of its total assets in Merck. The Fidelity MSCI Health Care ETF also holds 8.8% of its total assets in Johnson & Johnson (JNJ), 4.6% of its total assets in Gilead Sciences (GILD), and 3.1% of its total assets in Bristol-Myers Squibb (BMY).