Understanding the Correlation of Mining Stocks in 2017

Precious metal prices have been falling since Trump won the US Presidential election on November 8, 2016. Mining stocks quickly followed suit.

Jan. 30 2017, Updated 9:07 a.m. ET

Mining stocks and gold

It’s important to understand which mining stocks have overperformed and underperformed precious metals. Precious metal prices have been falling since Donald Trump won the US Presidential election on November 8, 2016. As a result, mining stocks have also been falling.

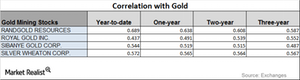

Mining companies that have high correlations with gold include Randgold Resources (GOLD), Royal Gold (RGLD), Sibnaye Gold (SBGL), and Silver Wheaton (SLW). These companies had risen significantly YTD (year-to-date) in 2016, prior to the fall in November and December, and then 2017 started with a price revival. (Remember, mining companies often amplify precious metals’ returns.)

Correlation trends

As you can see in the chart above, Randgold is the most correlated with gold on a YTD basis among the four stocks in this review. Royal Gold is the least correlated with gold.

Randgold and Sibanye saw its correlations to gold rise. Randgold’s correlation rose from a ~0.59 three-year correlation to a ~0.64 one-year correlation. The correlation of ~0.64 suggests that about 64% of the time, Randgold has moved in the same direction as gold in the past year. Usually, a fall in gold leads to falls in the prices of mining stocks and vice versa.

Notably, the relationships between gold and Silver Wheaton haven’t been stable, and have seen an upward-downward trend. Leveraged mining funds such as the Direxion Daily Junior Gold Miners ETF (JNUG) and the ProShares Ultra Silver ETF (AGQ) rose due to growth in precious metals.