Analysts’ Ratings and Recommendations for Pfizer

Wall Street analysts expect Pfizer’s (PFE) top line to rise 0.6% to ~$13.1 billion in 1Q17. Its earnings per share are expected to be $0.67 in the quarter.

May 1 2017, Updated 4:35 p.m. ET

Analysts’ estimates for Pfizer’s 1Q17

Wall Street analysts expect Pfizer’s (PFE) top line to rise 0.6% to ~$13.1 billion in 1Q17. Its earnings per share are expected to be $0.67 in the quarter.

Pfizer’s revenue is driven by operational rises in the revenues of both its Innovative Health business and its Essential Health business, including its legacy Hospira products. This operational growth is offset by the negative impact of foreign exchange.

Excluding legacy Hospira products, the Essential Health business’s growth is negative, as most of its products are exposed to competition from different products and brands.

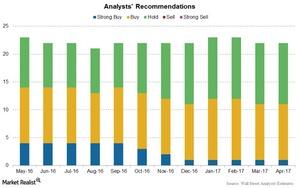

Analysts’ ratings

Pfizer’s stock price has risen nearly 3.1% over the last 12 months and ~4.4% year-to-date. Analysts’ estimates show that the stock has the potential to return ~11.4% over the next 12 months. Wall Street analysts’ recommendations show a 12-month target price of $37.80 per share on the stock, compared to its price of $33.92 on April 28, 2017.

Analysts’ recommendations

As of May 1, 2017, 22 analysts are tracking Pfizer. Of these 22 analysts, 11 recommend “buys,” while 11 recommend “holds” on the stock. Changes in analysts’ estimates and recommendations are based on changing trends in a stock’s price and a company’s performance.

The consensus rating for Pfizer is 2.45, which represents a moderate buy for value investors.

To divest company-specific risk, investors can consider ETFs such as the iShares US Healthcare ETF (IYH), which holds 6.8% of its total assets in Pfizer. The ETF also holds 6.2% of its total assets in Merck & Co. (MRK), 3.2% in Allergan (AGN), and 2.6% in Eli Lilly and Company (LLY).