How GST Bill Could Help Investment Scenario in 2017

The implementation of the Goods and Service Tax (or GST) in India is expected to begin on July 1, 2017.

April 12 2017, Updated 9:06 a.m. ET

Goods and service tax in India

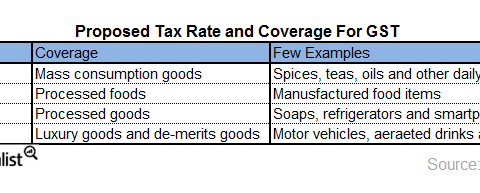

The implementation of the goods and service tax (or GST) in India is expected to begin on July 1, 2017. The Constitution Amendment Bill will replace existing multiple indirect taxes with uniform GST across India. The current indirect tax structure is considered a major hurdle in India’s economic growth and competitiveness. Let’s look at the proposed rates to be applied, according to the new reform in the below chart.

Proposed rates

The goods and service tax is expected to boost economic growth by improving business sentiment. The four different rates proposed will be applied to India’s goods and services tax as mentioned above. In other countries, a single tax rate is applied to all goods. However, the GST in India is expected to have four tax rates for different goods and services. The proposed tiers include a 5% tax likely to be applied to goods for daily needs. The 12%–18% will be the rate for processed goods. The 28% tax bracket will apply to luxury goods.

Benefits of the GST bill

The GST is expected to remove the various taxes and levies across the states and replace them with a single tax system. Some of its benefits include:

- reducing the cost of tax compliance and transaction costs, thereby making it easier to do business

- improving the government treasury by generating a steady revenue stream

Investment impact

According to Indian Finance Minister Arun Jaitley, the implementation of GST will boost GDP by 1–2% in 2017. The consumption growth and fiscal reforms are expected to drive economic growth in 2017, according to the Asian Development Bank (or ADB) report. The overall business sentiment is expected to improve in 2017 with the implementation of GST. The improved consumer confidence is expected to attract more foreign direct investment in India as well as domestic investments in capital markets (INDA) (INDY). The stable and transparent tax regime is expected to encourage foreign investment in India.

Investors can consider ETFs including the EGShares India Consumer ETF (INCO) and the VanEck Vectors India Small-Cap ETF (SCIF). The small-cap and consumer-related ETFs are expected to rise, as the consumer growth is directly linked to the domestic economy.

For more information on Indian markets, read Aftershock: Impact of Demonetization on India and Investments.