Why Short Interest in Valero Soared in 2017

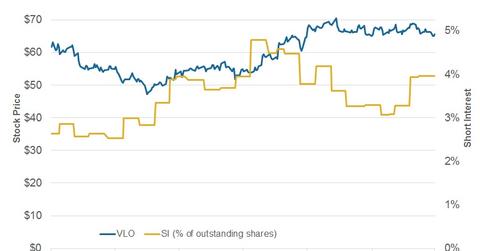

Valero Energy (VLO) has witnessed a rise in its short interest since mid-February 2017.

April 12 2017, Updated 10:37 a.m. ET

Short interest in Valero

So far in this series, we’ve analyzed Valero Energy’s (VLO) stock performance in 2017, analyst ratings for VLO, dividend yield, and the beta level of the company. In this part, we’ll look at changes in short interest levels.

Valero Energy (VLO) has witnessed a rise in its short interest since mid-February 2017. Short interest as a percentage of outstanding shares in Valero rose from 3.1% in mid-February to 4.0% at the end of March. This shows that the bearish sentiment for the stock is strengthening. Also, during the same period, VLO’s stock price fell 3%.

In February, VLO announced its 4Q16 results. During the quarter, earnings dropped sharply, and the RINs (Renewable Identification Number) cost was quite high. Plus, during the month, gasoline and distillate inventories stood at record levels, implying excess supply in comparison to demand for refined products in the market. Presumably, these factors led to the rise in short interest levels in Valero in February.

Peers’ short interest

Also, VLO’s peers Marathon Petroleum (MPC) and Phillips 66 (PSX) saw a rise in short interest (as a percentage of outstanding shares) by 0.36% and 0.16%, respectively, since mid-February. Delek US Holdings (DK), HollyFrontier (HFC), and PBF Energy (PBF) saw a sharper rise in short interest by 1.9%, 0.6%, and 2.0%, respectively.

If you are looking for exposure to mid-cap stocks, you can consider the SPDR S&P MIDCAP 400 ETF (MDY). The ETF also has ~4% exposure to energy sector stocks like HFC.

To learn about changes in institutional holdings levels in Valero, continue to the next part.