VLCC, Suezmax, and Aframax Rates Rose in Week 16

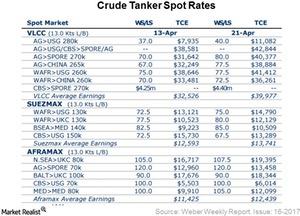

According to the Weber Weekly Report, VLCC rates on the benchmark route rose from $32,439 per day on April 13, 2017, to $38,884 per day on April 21, 2017.

April 25 2017, Published 10:37 a.m. ET

Tanker rates

In the previous part of this series, we saw that the BDTI (Baltic Dirty Tanker Index) rose in week 16, which ended on April 21, 2017. In this part, we’ll take a look at crude oil (DBO) tanker rates. Let’s see which tankers performed the best and the worst in week 16.

VLCC

According to the Weber Weekly Report, the Middle East market rebounded in week 16. A total of 16 fixtures were reported—53% higher week-over-week. In week 16, India led with nine fixtures out of 16.

According to the same report, VLCC rates on the benchmark route rose from $32,439 per day on April 13, 2017, to $38,884 per day on April 21, 2017. The average rate for all VLCC routes rose from $32,526 per day to $39,977 per day for the same period—a 23% rise week-over-week. DHT Holdings (DHT) and Euronav (EURN) primarily operate VLCCs.

Suezmax rates

According to the Weber Weekly Report, Suezmax vessels in the West African market observed modest rate upside in week 16 as charterers remained active covering early May cargoes.

According to the same report, the Suezmax rate on the benchmark route rose to $10,523 per day on April 13, 2017, from $12,129 per day on April 21, 2017. The average rate for all Suezmax routes rose from $12,593 per day on April 13, 2017, to $13,741 per day.

Nordic American Tankers (NAT) only operates Suezmax vessels. Teekay Tankers (TNK) and Tsakos Energy Navigation (TNP) have Suezmax vessels in their fleets.

Aframax rates

According to the Weber Weekly Tanker Report, Aframax rates on the Caribbean route rose from $5,500 per day on April 13, 2017, to $6,000 per day on April 21, 2017. The average rate for all Aframax routes rose to $12,439 per day from $11,425 per day for the same period.