Reading the Performances of Precious Metals in 1Q17

Precious metals had a bright first quarter, which ended March 31, 2017. Gold rose about 8.4%, marking its best quarter in almost a year.

April 5 2017, Published 10:40 a.m. ET

Last trading day of the quarter

Precious metals had a bright first quarter, which ended March 31, 2017. Gold rose about 8.4%, marking its best quarter in almost a year. Gold futures for May expiration ended the last trading of March on a positive note, rising about 0.24% and closing at $1,249.50 on March 31, 2017. The call implied volatility of gold, which measures changes in the price of an asset, with respect to variations in the price of the call option, also rose that day and was at 11.3%.

Silver followed in gold’s footsteps, rising about 0.28% and closing at $18.30 per ounce on March 31. Palladium rose marginally 0.08% and ended at $798.20 per ounce. Platinum was the only precious metal that had a bad day, falling about 0.38% and closing at $950 per ounce.

[marketrealist-chart id=2015035]

Economic indicators

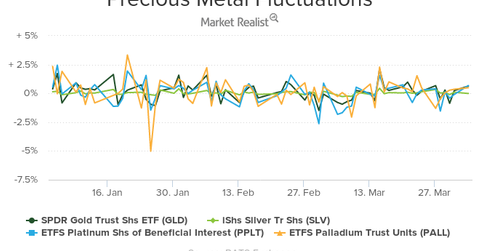

In the above graph, you can see the comparative performances of gold (GLD), silver (SLV), platinum (PPLT), and palladium (PALL) over the past six months.

The overall market sentiment has been the most important phenomenon that’s been playing on these metals in the first quarter. Donald Trump’s unexpected presidential victory left the markets in confusion, and precious metals kept rising slowly. The proposed healthcare bill at the end of March added more concerns for investors.

Another important indicator that moved these metals was the interest rate hike. In the next part of this series, we’ll look at the performance of gold next to US interest rates.

Precious metal mining stocks

Precious metal mining stocks had a mixed reaction in the first quarter due to the rise and fall in precious metals. Miners that have shined so far in 2017 include Alamos Gold (AGI), B2Gold (BTG), Royal Gold (RGLD), and Sibanye Gold (SBGL). They rose 17.4%, 19.0%, 10.6%, and 24.8%, respectively. Together, they make up about 9.3% of the VanEck Vectors Gold Miners ETF (GDX).

Next, let’s take a closer look at these top performing miners in 1Q17.