Performance of Eli Lilly & Co.’s Elanco in 1Q17

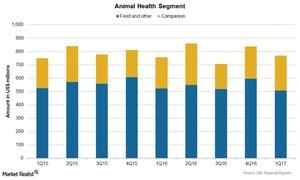

Eli Lilly & Co.’s (LLY) Animal Health company, Elanco, reported an increase of 2% in revenues to $769.4 million in 1Q17, compared to $754.6 million in 1Q16.

May 2 2017, Updated 9:06 a.m. ET

Elanco

Eli Lilly & Co.’s (LLY) Animal Health company, Elanco, reported an increase of 2% in revenues to $769.4 million in 1Q17, compared to $754.6 million in 1Q16. This segment contributed ~14.7% to the company’s total revenues and encompasses products for companion animals, as well as food and other products.

Revenues for the Animal Health segment

The US Animal Health sales increased 5% to $413.8 million during 1Q17, while Animal Health sales outside the US markets decreased 2% to $355.6 million, including revenues from Novartis (NVS) Animal Health.

The segment’s US revenues increased due to higher sales of new products added to the companion animal products portfolio. This portfolio reported growth of 23% to $175 million during 1Q17, which was partially offset by lower sales of dairy products due to market access pressures in international markets.

For international revenues, both food animal products and companion products reported a decline in revenues due to lower sales.

Companion animal products

Companion animal products reported a growth in revenues to $261.3 million in 1Q17. This includes a 23% increase in the US sales of companion animal products and a decline of 3% in sales of companion animal products outside the US markets.

Food and other products

The revenues for food and other products were $508.1 million in 1Q17. These revenues reported a decline of 4% in sales in the US, while the company reported a 1% decline in international sales, including a 1% operational decline and a marginal negative impact of foreign exchange.

Merck & Co. (MRK), Merial—a Sanofi (SNY) company, and Zoetis (ZTS), which is the animal health arm of Pfizer (PFE), compete with Lilly on certain product mixes.

For broad-based industry exposure, investors can consider the iShares Core High Dividend ETF (HDV), which holds ~1.5% of its total assets in Lilly.