How to Interpret Valuation Multiples in the Offshore Drilling Industry

Offshore drilling companies are capital-intensive and have varying degrees of financial leverage. Thus, we use the EV-to-EBITDA multiple as a valuation.

Nov. 20 2020, Updated 4:05 p.m. ET

Why EV-to-EBITDA?

Offshore drilling (OIH) companies are cyclical and volatile in nature. They’re also capital-intensive companies, have high levels of depreciation and amortization, and have varying degrees of financial leverage. Thus, the EV-to-EBITDA (enterprise value-to-earnings before interest, taxes, depreciation, and amortization) multiple is a preferable choice in the valuation of such companies.

A key valuation multiple driver

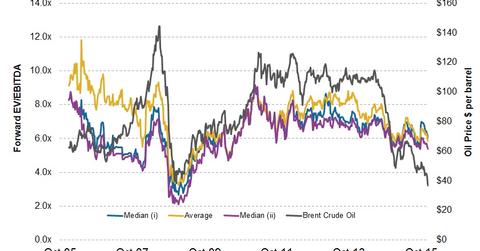

The forward EV-to-EBITDA reflects what investors are willing to pay for the next four quarters of estimated EBITDA. In the offshore drilling industry, we believe this metric reflects the perceived riskiness of investing in offshore drilling companies as well as of investor expectations for the industry’s outlook.

Historical valuations and companies included

Since 2009, we’ve observed that the industry’s valuation multiple has closely followed crude prices. With the 2015 fall in crude oil prices, the outlook of offshore drillers has become bleak, which has increased the risk of investing in offshore drilling companies and has lowered valuation multiples.

To calculate the industry EV-to-EBITDA, we have included the following companies: Ensco (ESV), Diamond Offshore (DO), Rowan Companies (RDC), Noble (NE), Pacific Drilling (PACD), Seadrill (SDRL), Transocean (RIG), and Atwood Oceanics (ATW).

Since 2005, the lowest average valuation multiple was 3.23x, observed in March 2009, while the highest multiple was 11.84x, which we saw in 2006. The average multiple for the offshore industry since 2005 is 7.25x.

For related analysis, check out Market Realist’s Energy and Power page.