Pacific Drilling SA

Latest Pacific Drilling SA News and Updates

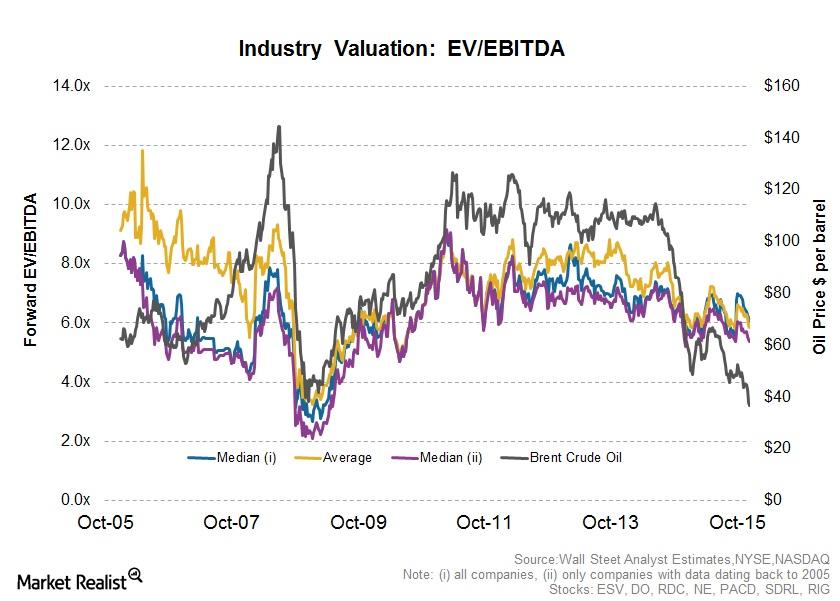

How to Interpret Valuation Multiples in the Offshore Drilling Industry

Offshore drilling companies are capital-intensive and have varying degrees of financial leverage. Thus, we use the EV-to-EBITDA multiple as a valuation.

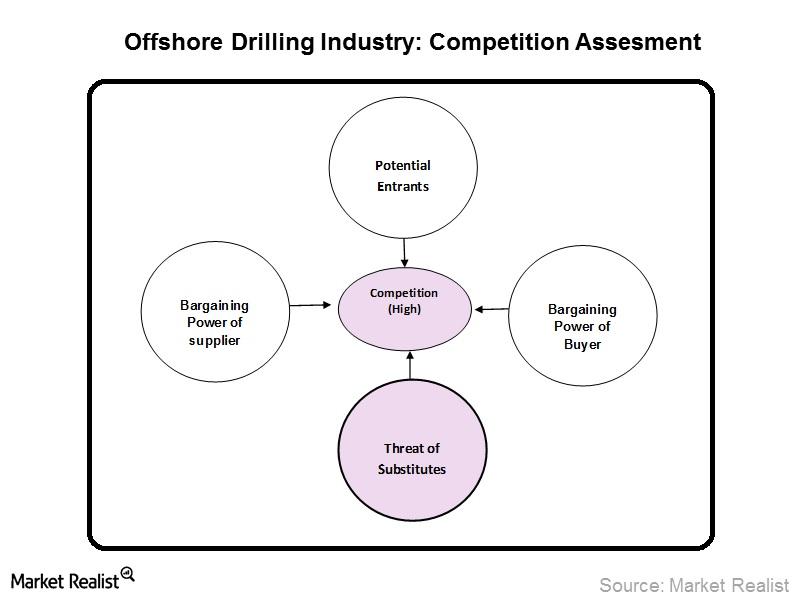

The Intense Competition in the Offshore Drilling Industry

The offshore drilling industry has a high degree of financial and operating leverage, which forces participants to engage in price competition.

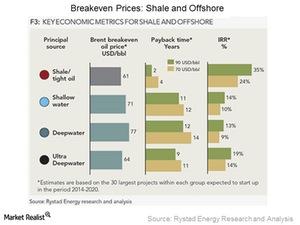

How Offshore and Onshore Drilling Perform when Oil Prices Tumble

Unconventional sources of onshore drilling have started gaining popularity in recent years, but the crude from these sources are costly to produce.

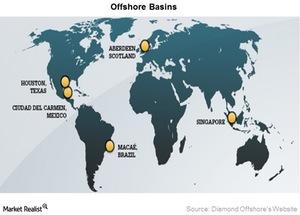

How Geography and Climate Impact Offshore Oil Rig Choices

The majority of offshore operations occur in six key locations worldwide that differ widely in terms of water depth, weather conditions, and remoteness.

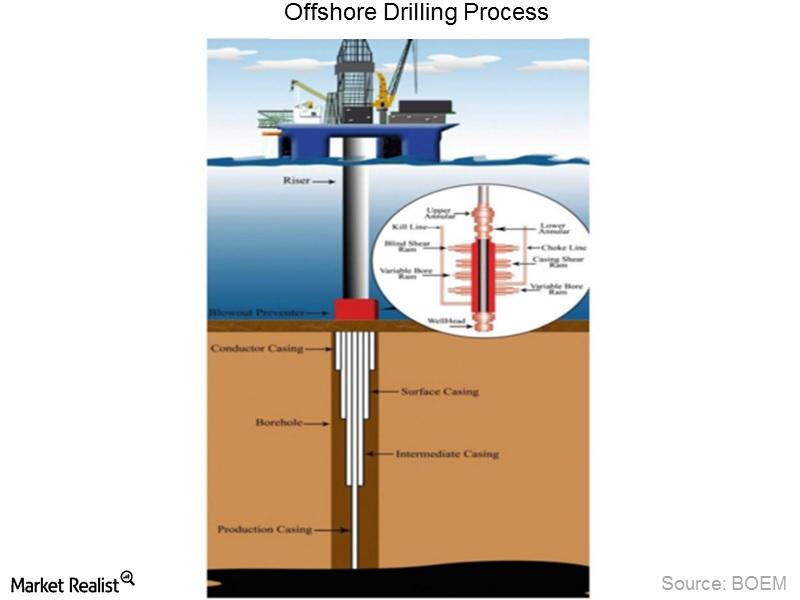

Why the Offshore Drilling Process Is so Complex and Costly

The offshore drilling process requires complex machinery and large crews. At every stage, things that can go wrong, so each stage requires special care.