Why the Majority of Analysts Rate Phillips 66 as a ‘Hold’

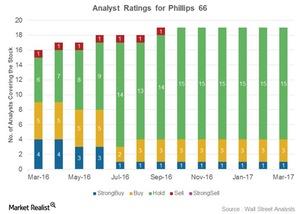

Fifteen out of the 19 analysts covering Phillips 66 (PSX) rated it as a “hold” in March 2017. Another four analysts rated PSX as a “buy” or a “strong buy.”

March 20 2017, Updated 9:07 a.m. ET

Analyst ratings for Phillips 66

As shown in the chart below, 15 out of the 19 analysts covering Phillips 66 (PSX) rated it as a “hold” in March 2017. Another four analysts rated PSX as a “buy” or a “strong buy.” PSX’s mean price target of $90 per share implies an ~12% gain from the current level.

Change in analyst ratings

In March 2016, Phillips 66 (PSX) had more “buy” ratings, fewer “hold” ratings, and one more “sell” rating than in March 2017. After its earnings release, Phillips 66 witnessed cuts in its target prices put up by various investment banking firms, which could be due to Phillips 66 missing its 4Q16 earnings estimate.

Morgan Stanley cut Phillips 66’s target price from $94 to $88. J.P. Morgan, which has a “neutral” rating on the stock, lowered its target price from $92 to $90. Similarly, RBC reduced PSX’s target price from $88 to $87. RBC has a “sector perform” rating on the stock.

Why the “hold” ratings?

Phillips 66’s (PSX) development plans across its business segments make its earnings model diversified and growth-oriented. Its inorganic and organic growth strategies in the Midstream segment could help Phillips 66 boost its stable midstream earnings. Also, PSX’s ongoing expansion and modernization activities in its Chemicals and Refining segments could enhance its earnings from these segments.

Most of the analysts rated PSX as a “hold” likely because of PSX’s premium valuations, which are already factoring in the company’s expected growth. We’ll discuss PSX’s valuation in more detail later in this series.

However, analysts are cutting target prices to reflect any deviation from the expected growth. The volatile refining environment is sharply altering the refining earnings, which impact downstream companies’ estimates, valuations, and ratings.

Peers ratings

Phillips 66’s (PSX) peers Tesoro (TSO), Valero Energy (VLO), and Marathon Petroleum (MPC) have received “buy” ratings from 72%, 62%, and 90% of analysts, respectively. Among the smaller players, Delek US Holdings (DK), Alon USA Energy (ALJ), and Western Refining (WNR) received “buy” ratings from 35%, 25%, and 25% of analysts, respectively.

For exposure to small-cap value stocks, you can consider the iShares Russell 2000 Value ETF (IWN). IWN has ~5% exposure to energy sector stocks, including DK, ALJ, and WNR.

Move on to the next part to see how Phillips 66’s dividend yield has trended.