What Wall Street Analysts Are Saying about Eli Lilly

Eli Lilly (LLY) reported EPS (earnings per share) of $2.58 on revenue of $21.2 billion in 2016, compared to EPS of $2.26 on revenue of $20.0 million in 2015.

April 4 2017, Updated 7:36 a.m. ET

Analysts’ estimates

Eli Lilly (LLY) reported EPS (earnings per share) of $2.58 on revenue of $21.2 billion in 2016, compared to EPS of $2.26 on revenue of $20.0 million in 2015.

Further to this, the company is expected to report EPS of $4.10 on revenue of $22.2 billion in 2017, a 4.4% rise compared to its 2016 revenue. It’s expected to report EPS of $4.40 on revenue of $22.3 billion in 2018.

Quarterly estimates

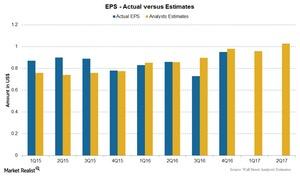

LLY’s 4Q16 revenue surpassed Wall Street analysts’ estimates. The company reported revenue of $5.8 billion, compared to analysts’ estimate of $5.6 billion.

Analysts expect the company to report EPS of $0.96 with a revenue rise of 7% to $5.2 billion in 1Q17. They expect the company to report EPS of $1.03 with a revenue rise of ~3.5% to $5.6 billion in 2Q17.

Analysts’ recommendations

Eli Lilly’s stock price has risen ~18.2% over the last 12 months. Analysts estimate that the stock has the potential to return ~3.9% over the next 12 months. Analysts’ recommendations show a 12-month target price of $88.05 per share, compared to the stock’s last price of $84.75 per share on March 29, 2017.

A total of 77.7% of analysts recommend “buys,” and 22.3% of analysts recommend “holds” on LLY. Changes in analysts’ estimates and recommendations are based on changing trends in the stock’s price.

To avoid company-specific risks, investors can consider ETFs such as the iShares Core High Dividend ETF (HDV), which holds 1.5% of its total assets in Eli Lilly, 5.8% in Johnson & Johnson (JNJ), 4.9% in Pfizer (PFE), and 3.5% in Merck & Co. (MRK).