These Mining Stocks Have Downward Trending Correlations with Gold

Uncertainty in the market significantly affects the performances of precious metals. It also affects precious metals mining stocks, which are known to closely track precious metals.

March 14 2017, Published 3:57 p.m. ET

Mining stocks and gold

Uncertainty in the market significantly affects the performances of precious metals. It also affects precious metals mining stocks, which are known to closely track precious metals.

Precious metals stocks (SGOL) (SIVR) are often more carefully synced to the metals they mine than to the overall equity market (SPY). It’s important to know which mining stocks have overperformed and which have underperformed precious metals.

The buoyancy of precious metals could be challenged even further by future interest rate hikes, which could cause mining stocks to fall.

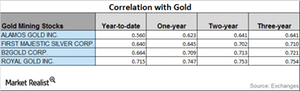

Mining companies that have high correlations with gold include Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD). Although mining companies often amplify the returns of precious metals, they’ve shown mixed performances in the past week.

Upward and downward trends

While all the stocks listed above are closely related to precious metals, Royal Gold has the highest correlation with gold year-to-date. First Majestic has the lowest correlation with gold.

Over the past three years, B2Gold, First Majestic, and Royal Gold have seen downward-trending correlations with gold. Alamos Gold has seen both upward and downward trends.

B2Gold’s correlation has fallen from a ~0.72 three-year correlation to a ~0.66 year-to-date correlation. A correlation of ~0.66 means that ~66% of the time, B2Gold has moved in the same direction as gold in the last year. Usually, a fall in gold leads to falls in mining stocks, and vice versa.