Nitrogen Producers’ Realized Prices: A Key Comparison

In 4Q16, the average price of ammonia for the five producers in our chart fell by an average of 38%.

March 8 2017, Updated 10:37 a.m. ET

Nitrogen prices

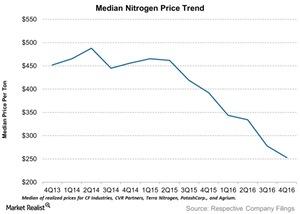

In the preceding part of this series, we discussed the shipment growths for nitrogen producers (MOO). Despite the growth in nitrogen shipments, most companies experienced a decline in sales, primarily because the decline in realized prices offset the growth from shipment volume. Now, let’s look at their average realized price trend for nitrogen fertilizers as of 4Q16.

Median prices decline

In the chart above, we’ve taken a median of the aggregated the quarterly realized prices of different nitrogen fertilizer types from five nitrogen producers that we’ve discussed so far. You can see that the median realized price of the nitrogen fertilizer was significantly lower in 4Q16, as compared to levels in 4Q13. Now let’s dig deeper into nitrogen fertilizer prices by product type.

Ammonia prices

In 4Q16, the average price of ammonia, which is further upgraded to urea and UAN, for the five producers in the chart above, fell by an average of 38%. Of these producers, PotashCorp (POT) saw its ammonia price fall by 51% to $235 per short ton, followed by Terra Nitrogen (TNH), which saw its ammonia price fall by 45% to $253 per short ton YoY (year-over-year).

CF Industries’ (CF) ammonia realized prices fell 38% to $277 per short ton. CVR Partners’ (UAN) also fell 26% to $352 per ton YoY, while Agrium’s (AGU) average ammonia price fell by 22% to $409 per ton.

Urea prices

Urea, which is the most applied nitrogen fertilizer across the globe, also saw its average price fall by 30% for the above producers. Below is a 4Q16 performance breakdown:

- CF Industries’ urea price fell by 32% to $214 per short ton

- PotashCorp’s urea price fell by 30% to $270 per short ton

- Agrium’s urea price fell by 28% to $302 per short ton

UAN prices

Similar to ammonia and urea prices, UAN prices also fell by an average of 38% in 4Q16, as compared to the corresponding quarter a year ago. Terra Nitrogen saw its average realized prices fall by 40% to $127 per short ton, while CF Industries’ saw its price fall 38% to $149 per short ton. CVR Partners’ UAN prices fell by 25% to $147 per short ton.

The fall in nitrogen fertilizer’s price was the result of an increase in supply supported by low prices for natural gas.

Next, we’ll look at nitrogen gross margins, which matter most for these producers.