Here Are the Short-Term Risks to the Bond Markets

The key risk faced by bond markets is a sudden fall in prices.

Aug. 24 2017, Updated 6:41 a.m. ET

Sudden rise in inflation could pose a threat to the bond markets

The key risk faced by the bond markets is a sudden fall in prices. Let’s see why that could happen. Bond (BND) prices are inversely related to yields, and yields rise when interest rate expectations rise. Right now, the markets aren’t pricing in any rate hikes from the Fed for the rest of the year. The probability of a rate hike in December 2017 is less than 40.0%. The bond markets (GOVT) aren’t prepared for this possibility, and a surprise rate hike could lead to volatility in the markets.

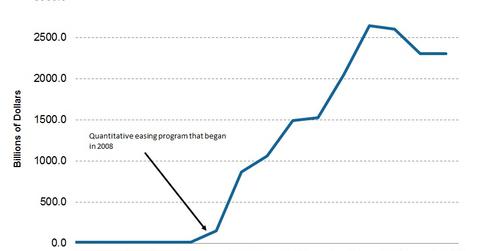

Balance sheet unwinding will likely be announced in September

In its July 2017 policy statement, the FOMC (Federal Open Market Committee) said that the process of unwinding the balance sheet may start “relatively soon.” The Fed has clearly defined the path it will follow to reduce the size of its $4.5 trillion balance sheet. The proposed plan most likely won’t have any major impact on the bond (AGG) markets since the Fed intends to unwind a tiny portion of its balance sheet every month.

Risks are skewed toward further tightening

The markets are expecting the Fed to hold off on further rate hikes while it initiates the balance sheet unwinding program. That’s a baseline scenario, but if the Fed surprises the markets, volatility (VIXM) could rise, leading to a fall in bond prices. The US economy and inflation (VTIP) are likely to accelerate further in the coming months. The recent uptick in economic indicators indicates that the US economy is currently continuing to expand. That might lead to higher yields in the future. The bottom line is that 2017 could continue to be calm for bonds (BSV), but major risks could emerge in 2018.

Be sure to read Alan Greenspan’s warning about a possible bond market bubble.