What Will Drive AstraZeneca’s Oncology Revenues in 2017?

In 2016, AstraZeneca’s (AZN) poly ADP-ribose polymerase (or PARP) inhibitor, Lynparza, managed to report revenues close to $218 million.

March 22 2017, Updated 7:38 a.m. ET

Lynparza growth trends

In 2016, AstraZeneca’s (AZN) poly ADP-ribose polymerase (or PARP) inhibitor, Lynparza, managed to report revenues close to $218 million. The drug has captured a significant market share as a monotherapy for patients who suffer from advanced ovarian cancer with deleterious or suspected deleterious germline BRCA mutation and who have been previously treated with at least three lines of chemotherapy. Since the use of this drug is based on first testing patients with companion diagnostic tests, it enables the therapy to reach the most appropriate patients and ensures maximum response rates. The increasing use of these diagnostic tests has also become a key driver for increasing the use of Lynparza around the world.

If these growth trends continue in 2017, it may have a positive impact on share prices of the company as well as those of the First Trust Value Line Dividend Index Fund (FVD). AstraZeneca makes up about 0.57% of FVD’s total portfolio holdings.

Tagrisso growth trends

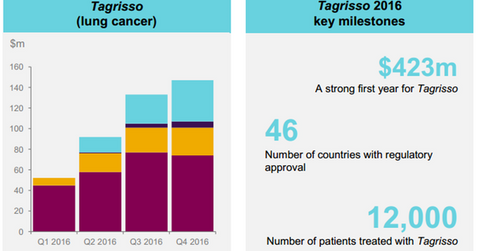

In 2016, Tagrisso reported global revenues of $423 million driven by solid performance across the US, Europe, and Japan. The drug has already secured 46 regulatory approvals.

In 4Q16, revenue growth for Tagrisso in the US fell slightly on a sequential basis because some non-small cell lung cancer (or NSCLC) patients with metastatic epidermal growth factor receptor (or EGFR) T790 mutation witnessed disease progression as they waited for treatment. It was a part of the built-up demand for the drug that existed when Tagrisso was launched in the US.

However, the increasing rate of testing for the T790 mutation in NSCLC patients is expected to boost demand for Tagrisso in future years. Currently, around 50% of the eligible patients are tested for this mutation. Further, the recently approved blood-based companion diagnostic test for Tagrisso is expected to further help the uptake of Tagrisso due to increased convenience of use.

AstraZeneca, however, is competing with other oncology players such as Pfizer (PFE), Merck (MRK), and Bristol-Myers Squibb (BMY) in the Japanese market.

In the next article, we’ll discuss operating expenses for AstraZeneca in greater detail.