Could Novartis’s CTL019 Capture Significant Market Share?

Currently, an estimated 7,000 patients suffer from pediatric ALL in the US, Europe, Japan, Canada, and Israel.

April 4 2017, Updated 7:36 a.m. ET

Acute lymphoblastic leukemia market trends

In 1Q17, Novartis (NVS) plans to file an application with the US Food and Drug Administration (or FDA) seeking approval for its investigational chimeric antigen receptor T cell (or CAR T) drug, CTL019, in relapsed/refractory pediatric B-cell acute lymphoblastic leukemia (or ALL) indications. The company will also file an application with the European Medicines Agency (or EMA) for CTL019 in late 2017.

Currently, an estimated 7,000 patients suffer from pediatric ALL in the US, Europe, Japan, Canada, and Israel. Out of these, approximately 1,100 patients are eligible for second-line therapy with CTL019 while around 700 patients are eligible for third-line ALL therapy with the drug.

If CTL019 manages to capture a significant share of the ALL market, it could have a positive impact on Novartis stock as well as the First Trust Value Line Dividend Index Fund (FVD). Novartis makes up about 0.52% of FVD’s total portfolio holdings.

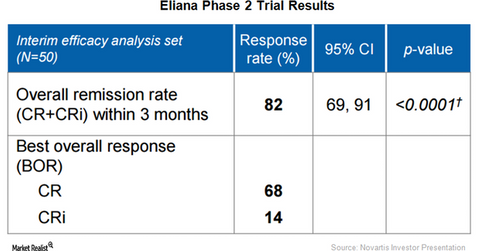

Eliana trial results

On December 4, 2016, Novartis presented positive data from its phase two trial, ELIANA, which evaluated the efficacy and safety of its investigational chimeric antigen receptor T cell (or CAR T) drug, CTL019, in relapsed/refractory pediatric B-cell acute lymphoblastic leukemia cases. With 82% of the tested patients demonstrating complete response within three months of initiation of therapy, CTL019 has managed to meet the primary endpoint in the trial.

Besides efficacy, the drug has also demonstrated a favorable safety profile in the trial. None of the treated patients died due to neurologic toxicities or cytokine release syndrome. Plus, there were no reported cases of patients having suffered from cerebral edema.

CTL019 is thus expected to enable Novartis to become a major player in the rare cancer segment similar to peers such as Amgen (AMGN), Pfizer (PFE), and Merck (MRK).

In the next article, we’ll explore growth prospects for Novartis in the sickle cell disease segment.