Inside Sanofi’s Overall Revenue Performance in 2016

Sanofi (SNY) reported a YoY (year-over-year) revenue growth of ~1.2% at constant exchange rates for 2016.

March 31 2017, Updated 5:06 p.m. ET

Sanofi’s revenues

Sanofi (SNY) reported a YoY (year-over-year) revenue growth of ~1.2% at constant exchange rates for 2016. However, the negative impact of foreign exchange has more than offset its operational growth, and the company reported revenues of ~33.8 billion euros (about $36.1 billion) in 2016, which is ~0.7% lower than its 2015 revenues of ~34.1 billion euros (about $36.4 billion).

Reorganization of the group

Sanofi’s business was reorganized as of January 1, 2016, and now consists of the following five business units:

- Sanofi Genzyme, the specialty care business that includes multiple sclerosis, rare diseases, and oncology

- Diabetes and Cardiovascular

- Generic Medicines and Emerging Markets (including pharmaceutical sales for emerging markets)

- Consumer Healthcare

- Sanofi Pasteur, or the Human Vaccines segment

On January 1, 2017, Sanofi and Boehringer Ingelheim announced the completion of the exchange of Merial, Sanofi’s animal health business and Boehringer Ingelheim’s consumer healthcare business in major markets. Merial reported a growth of 7.7% to ~2.7 billion euros (about $2.9 billion) in 2016, as compared to ~2.5 billion euros (about $2.7 billion) in 2015.

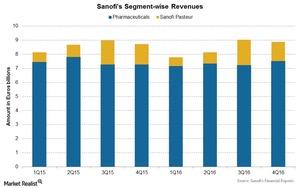

Segment-wise performance 2016

Sanofi’s business is also organized into following business segments:

- Pharmaceuticals: Sanofi Genzyme, Diabetes, and Cardiovascular, Established Pharmaceuticals, Consumer Healthcare, and Generics

- Human Vaccines, or Sanofi Pasteur

The Pharmaceuticals segment’s revenues fell 1.9% YoY to ~29.2 billion euros (about $31.3 billion) in 2016. This included an operational growth of 0.2%, more than offset by over 2% negative impact of foreign exchange in 2016. The segment is classified into the major unites of Genzyme, Diabetes and Cardiovascular, Consumer Healthcare, Generics, and Established prescription products. The increase in operational revenues in the segment was driven by multiple sclerosis, cardiovascular and rare diseases.

Sanofi Pasteur’s revenues rose 7.4% YoY to ~4.6 billion euros (about $4.9 billion) in 2016. This included an operational increase in revenues by 8.8%, partially offset by a 1.4% negative impact of foreign exchange. The growth was mainly driven by increased sales of meningitis vaccines, influenza vaccines, and Polio/Pertussis/Hib vaccines, partially offset by adult booster vaccines.

Notably, to divest risk, investors can consider ETFs like the First Trust Value Line Dividend ETF (FVD), which has 0.5% of its total assets in Sanofi, 0.5% of its total assets in Amgen (AMGN), 0.5% of its total assets in Teva Pharmaceutical Industries (TEVA), and 0.5% of its total assets in Novartis (NVS).

Continue to the next part for a closer look at the Sanofi Genzyme segment.