How Does Tesoro’s PEG Compare to Its Peers’?

In this article, we’ll compare Tesoro’s (TSO) PEG ratio (price-to-earnings to blended growth rate) to those of its peers. We’ve considered the mean estimate of PEG.

March 24 2017, Updated 7:36 a.m. ET

Tesoro’s PEG

In this article, we’ll compare Tesoro’s (TSO) PEG ratio (price-to-earnings to blended growth rate) to those of its peers. We’ve considered the mean estimate of PEG, which depicts the stock’s valuation after factoring in its expected future growth rate. Usually, all else being equal, a PEG ratio of lower than 1 signifies an undervalued stock.

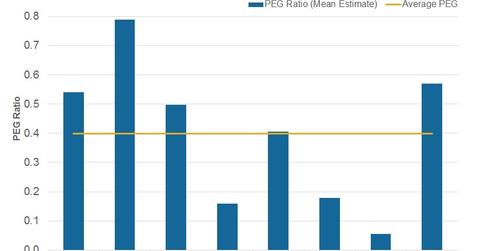

Tesoro’s PEG ratio stands at 0.54, above the peer average of 0.40. The peer average considers the average PEGs of eight American downstream companies.

Peers’ PEG ratios

Though it’s above the peer average, Tesoro’s PEG ratio is still below Marathon Petroleum’s (MPC) and Phillips 66’s (PSX) PEG ratios of 0.79 and 0.57, respectively. Usually, all else being equal, the higher the PEG, the more expensive the stock after considering future growth. Valero Energy’s (VLO) 0.5 PEG is lower than TSO’s.

Other small players HollyFrontier (HFC) and PBF Energy (PBF) are also below the peer average, with PEGs of 0.16 and 0.18, respectively. If you’re looking for exposure to mid-cap stocks, you can consider the SPDR S&P MidCap 400 ETF (MDY). The ETF has ~3% exposure to energy sector stocks, including HFC.