Balance Sheet Analysis of the Major Airline Carriers

In 4Q16, regional carrier Spirit Airlines (SAVE) had a leverage ratio of 0.96x, JetBlue Airways (JBLU) had a leverage ratio of 0.83x, and Alaska Air Group (ALK) had a leverage ratio of 0.36x.

April 3 2017, Updated 7:35 a.m. ET

Comparing the airlines

The capital-intensive airline industry is marked by significant investment in building infrastructure, as well as acquiring and maintaining aircraft and other equipment. As a result, airline stocks generally have high levels of debt on their balance sheets.

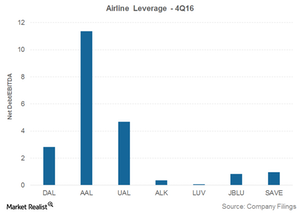

Legacy players typically have high levels of debt, while regional players seem to have managed their debt well. The chart below shows that at the end of 4Q16, American Airlines (AAL) had the highest leverage ratio of 11.4x. AAL is followed by United Continental (UAL), with a leverage ratio of 4.7x, and Delta Air Lines, (DAL), which has a leverage ratio of 2.8x.

In 4Q16, regional carrier Spirit Airlines (SAVE) had a leverage ratio of 0.96x, JetBlue Airways (JBLU) had a leverage ratio of 0.83x, and Alaska Air Group (ALK) had a leverage ratio of 0.36x. Southwest Airlines seems to be the most efficient carrier with a net debt-to-EBITDA[1. earnings before interest, tax, depreciation, and amortization] ratio of -0.08x.

Why pay attention to leverage?

Leverage tends to make a stock volatile and could increase the risk for investors. The airline industry’s fundamentals have improved tremendously, and its margins seem to have peaked.

If margins decline as analysts estimate, it could mean reduced cash flows. Declining cash flows could make it difficult to make interest payments, leaving less on the table for investors. All three legacy players had previously declared bankruptcy due to high and unmanageable debt.

On the other hand, if airlines can maintain this balance between debt and cash, it would put them in a much better position than their peers that hold significant debt.

Investors can gain exposure to the industry through the iShares Transportation Average ETF (IYT), which invests 23% of its portfolio in airlines.