Analysts’ Recommendations and Price Target for CF Industries

On March 13, 2017, five of the 18 analysts covering CF Industries (CF) recommended a “strong buy” to a “buy” for the next 12 months, down from six analysts in February.

Nov. 20 2020, Updated 2:53 p.m. ET

About CF Industries

CF Industries (CF) is the largest producer of nitrogen fertilizer in North America (SPY). It uses natural gas as a raw input material to produce nitrogen fertilizer, unlike most of its Chinese counterparts. Please read Here’s What’s Ahead for Nitrogen Investors to learn about the supply-demand dynamics in 2017.

In this article, we’ll see what analysts are recommending for CF Industries over the next 12 months.

Analyst recommendations

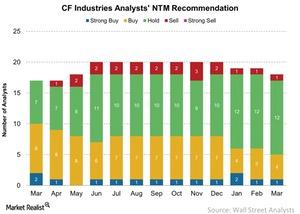

On March 13, 2017, five of the 18 analysts covering CF Industries (CF) recommended a “strong buy” to a “buy” for the next 12 months, down from six analysts in February.

Like PotashCorp (POT), Mosaic (MOS), and Agrium (AGU), CF Industries has a high concentration of recommendations. Twelve analysts recommended a “hold” over the next 12 months, which remained unchanged month-over-month. Only one analyst recommended a “sell” for the stock, and none of them recommended a “strong sell.”

Price target

On March 13, 2017, the consensus price target for CF Industries was $33.41 per share over the next 12 months, which is lower than $30.95 from our last report in February. CF Industries stock closed at $29.40 per share on March 13, which is an 11.9% discount to the analysts’ price target.

In the next part of this series, we’ll look at the ratings and price target for Intrepid Potash (IPI).