Phillips 66’s Recommendations: What the Analysts Are Saying Now

After its 4Q16 results, four of 19 analysts assigned “buy” or “strong buy” recommendations to Phillip’s 66 stock, while 15 assigned “holds.”

Feb. 7 2017, Updated 9:07 a.m. ET

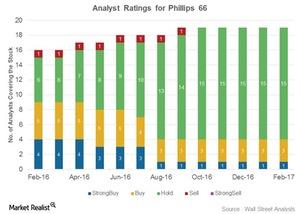

Analyst ratings for PSX

In this series, we’ve examined Phillips 66’s (PSX) 4Q16 earnings as compared to its previous estimates. We also analyzed PSX’s refining margin trend in 4Q16 and discussed the stock’s performance after the earnings release on February 3, 2017.

Now let’s examine the analyst ratings for PSX.

After releasing its 4Q16 earnings results, four (or 21%) of 19 analysts have assigned “buy” or “strong buy” recommendations to Phillip’s 66 stock, while 15 (or 79%) assigned “hold” recommendations. No analyst has assigned a “sell” or “strong sell” recommendation on the stock.

Phillips 66 could witness a change in ratings in the days to come as analysts examine the 4Q16 numbers more closely. PSX’s mean target price of $92 per share implies a 15% gain from its current level.

Analyst ratings for peers

Peers Delek US Holdings (DK), HollyFrontier (HFC), and Western Refining (WNR) have been recommended as “buy” by 36%, 31%, and 25% of analysts, respectively. Downstream peers PBF Energy (PBF) and Alon USA Energy (ALJ) have been recommended as “buy” by 42% and 25% of analysts, respectively.

Notably, for exposure to small-cap stocks, you can consider the iShares Russell 2000 Value ETF (IWN) (RUT-INDEX). IWN has ~6% exposure to energy sector stocks, including DK, WNR, and ALJ.

In the next part and final part, we’ll look at the changes in implied volatility in Phillips 66 after its 4Q16 earnings results.