Is Oasis Petroleum Stock Worth the Bet?

Oasis Petroleum (OAS) hasn’t had a good 2017 so far. In early February, the stock declined with several other energy stocks.

Feb. 17 2017, Updated 10:37 a.m. ET

Oasis Petroleum’s stock performance

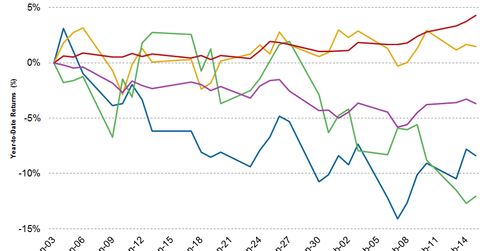

Oasis Petroleum (OAS) hasn’t had a good 2017 so far. In early February, the stock declined with several other energy stocks alongside crude oil prices, driven by concerns about increased supplies. Because oil makes up more than 80% of OAS’s production mix, any weakness in oil prices affects OAS stock significantly.

Since the beginning of 2017, Oasis Petroleum stock has fallen ~8.4%. Crude oil prices have risen ~1.5% however, during the same period. Meanwhile, the broader energy ETF—the Energy Select Sector SPDR ETF (XLE)—has fallen ~4% in the same period. The broader market ETF, the S&P 500 (SPY) (SPX-INDEX), has risen 4.3%

Crude oil prices seem to be recovering, which could give OAS stock a boost. OAS’s stock movements will also depend heavily on its 4Q16 performance. On a YoY (year-over-year) basis, the stock has risen ~211%.

Yellen talks, everyone listens

The rally in the broader market, especially in the past few days, has been fueled by Fed Chair Janet Yellen’s comments on February 14 about rate hikes on the horizon if the US economy remains on track.

The SPDR S&P 500 ETF (SPY) (SPX-INDEX) has risen ~1% since the announcement. The SPDR Dow Jones Industrial Average ETF (DIA) (DJIA-INDEX) rose 1.1%, while the Fidelity NASDAQ Composite Index ETF (ONEQ) (COMP-INDEX) rose ~1%.

To know more about OAS’s stock movements this year, read Is Oasis Petroleum’s Rally at the End of Its Road?

Continue to the next part for a look at OAS’s analyst price targets.