What Are the Drivers of Goldcorp’s Production Growth?

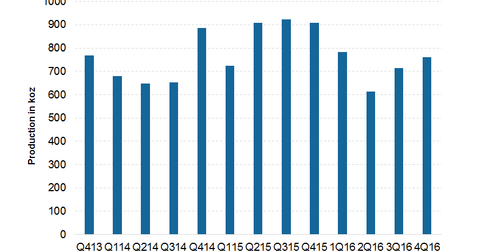

Goldcorp’s gold production fell 16% year-over-year in 4Q16 to 761,000 ounces. The company’s management had guided for 2.8 million–3.1 million ounces of gold production in 2016.

Feb. 17 2017, Updated 4:35 p.m. ET

Fall in production

Goldcorp’s (GG) gold production fell 16% year-over-year in 4Q16 to 761,000 ounces. The company’s management had guided for 2.8 million–3.1 million ounces of gold production in 2016. Its actual production came in at 2.87 million ounces, which was within the guided range.

Goldcorp’s production growth

During its investor day in January 2017, the company outlined its production growth path for the next five years. The company has committed $1 billion to growth. It expects to see production growth of 20% to 3 million ounces in the next five years. The main drivers of the increase included the following:

- ramping up Eleonore and Cerro Negro to their nameplate capacity levels by mid-2018

- improving grades at Penasquito

- improving recoveries and increasing production by 120,000 ounces per year at Pyrite Leach

- driving production growth toward the back end of its production profile via Coffee and Borden

For a detailed discussion of Goldcorp’s future production and cost reduction drivers, read Will 2017 Mark a Turnaround in Goldcorp’s Fortunes?

Peers’ productions

Goldcorp’s peers (GDX) (GDXJ) are also making every effort to increase their productions. Barrick Gold’s (ABX) production profile looks to be falling going forward for several years, mainly due to its non-core asset sales.

Newmont Mining (NEM) expects its 2016 gold production to be 4.8 million–5.0 million ounces. It will report its 4Q16 results on February 21, 2017. Kinross Gold’s (KGC) management is focusing on doubling its mineral reserve estimates by the end of 1Q17.

In the next article, we’ll look at Goldcorp’s cost performance and outlook.