AstraZeneca’s Other Products Segment Is Losing Market Share

For 2016, Synagis reported 2% growth at constant exchange rates, following its 14% growth in sales in the US.

March 1 2017, Updated 9:05 a.m. ET

Other Products segment

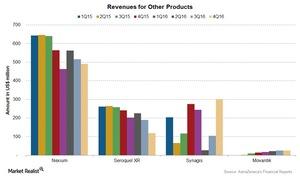

AstraZeneca’s (AZN) Other Products segment include products from the Infection, Neuroscience, and Gastrointestinal franchises. With lower sales of blockbuster drugs Nexium and Seroquel, the contribution of this segment fell to ~22% in 2016.

Overall, the segment’s revenues fell ~24% at constant exchange rates during 2016. In this final article of the series, we’ll explore AZN’s key products and their performance.

Nexium

Nexium, a blockbuster drug from AstraZeneca (AZN), is a gastrointestinal medicine is used to treat acid-related disorders. The US patents for Nexium expired in February 2015.

Nexium reported an 18% decline in revenues at constant exchange rates to ~$2.0 billion for 2016, with a 39% decline in its US revenues, an 11% decline in its sales in Europe, and a 3% decline in emerging markets.

We expect Nexium’s revenues to keep declining until the drug absorbs the effects of patent expiry and pricing pressures due to its generic competition.

Seroquel XR

Seroquel XR is a neuroscience medicine used to treat schizophrenia. Seroquel XR reported a 27% decline to $735 million in its 2016 revenues at constant exchange rates. This decline follows the competition from generic products, mainly in European markets.

Seroquel competes with drugs like Zyprexa from Eli Lilly & Co. (LLY), Abilify from Bristol-Myers Squibb (BMY), and Invega from Johnson & Johnson (JNJ).

New drugs

The new drugs in this segment include Synagis and Movantik. Synagis is used to prevent lung infections resulting from the use of breathing tubes in infants and children. Synagis is sold mostly in European markets. Movantik is used to treat opioid-induced constipation in adults.

For 2016, Synagis reported 2% growth at constant exchange rates, following its 14% growth in sales in the US. Movantik was launched in March 2015, and the US markets reported the majority of Movantik’s sales. Movantik’s total sales reached $91 million in 2016.

FluMist/Fluenz reported a 59% decrease in revenues to $104 million. This decrease was due to the Advisory Committee on Immunization Practices of the US Centres for Disease Control and Prevention’s recommendation not to use FluMist Quadrivalent in the US for the 2016–2017 influenza season.

To divest any company-specific risk, investors can consider the iShares S&P Global 100 ETF (IOO), which holds 0.7% of its total assets in AstraZeneca.