What Do Analysts Expect for Mosaic’s 4Q16 Gross Margin?

Wall Street analysts estimate that Mosaic (MOS) could report gross income of $209 million, which represents a 41% year-over-year fall from $355 million in 4Q15.

Feb. 3 2017, Updated 10:37 a.m. ET

Gross margins

In the earlier part of this series, we saw that The Mosaic Company (MOS) is estimated to report a 17% decline in revenues in its upcoming 4Q16 earnings. This weakness in revenue growth is also expected to trickle down to the company’s gross margins.

Analysts’ estimates

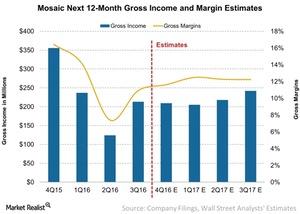

Wall Street analysts estimate that Mosaic (MOS) could report gross income of $209 million, which represents a 41% year-over-year (or YoY) fall from $355 million in 4Q15. This would also contract the company’s gross margins to 12% in 4Q16 from 16% in 4Q15.

For the next 12 months, analysts are estimating the company’s gross income to come in at $873 million, down from $989 million in the last 12 months. However, the company’s gross margins (gross income over total sales) is expected to fall 30 basis points YoY to 12.5%.

Lowering the cost of production

Stable gross margins in the wake of lower fertilizer prices indicate the company’s ability to lower the cost of production. Peers PotashCorp (POT) and Intrepid Potash (IPI) have switched to their low-cost facilities to produce fertilizer.

In its recent 4Q16 earnings release, PotashCorp stated that it would lower its cost of production for potash fertilizers. PotashCorp’s merger with Agrium (AGU) could present a challenge for other industry (SOIL) players. Movements in sales volumes and realized prices should be the focus during Mosaic’s upcoming earnings release.

Next, we’ll discuss the estimates for Mosaic’s EBITDA margins.