BlackRock’s Valuations Stable amid Strong Operating Performance

BlackRock is currently trading at a forward price-to-earnings ratio of 17.6x, compared with the industry average of 18.6x.

Jan. 24 2018, Updated 7:30 a.m. ET

Fair valuations

BlackRock’s (BLK) diversified offerings and product classes have helped it attract strong inflows in the recent quarters. In 2017, the company attracted record new flows of $367.0 billion, ~6.0% of the total assets under management.

It has seen strong traction toward iShares, institutional index funds, and debt investment by its retail clientele in recent quarters.

Unless there is a major correction in equity markets (SPY) (SPX-INDEX), BlackRock and competitors such as State Street Advisors (STT) and Vanguard are expected to see strong flows toward equity and debt-related offerings.

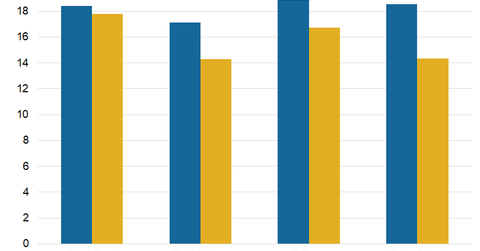

BlackRock is currently trading at a forward PE (price-to-earnings) ratio of 17.6x, compared with the industry average of 18.6x.

The company’s valuations have remained stable due to strong earnings growth expectations in 1H18 and 2018. The growth from active and passive offerings across the asset classes has driven its base and performance fees.

BlackRock’s peers are trading at the following forward PE ratios:

Together, these companies comprise 4.5% of the Vanguard Financials ETF (VFH).

Performance of active funds

BlackRock (BLK) earned $2.9 billion in investment advisory fees in 4Q17, a rise of 16.5% on a year-over-year basis. This increase was helped by a rise in assets under management and growth in valuations of holdings. The company’s performance fees stood at $285.0 million on active fund offerings.

In comparison to the benchmarks, BlackRock’s scientific active equity and active taxable fixed income outperformed by 83.0% and 81.0%, respectively, for a one-year period. These numbers stood at 87.0% and 73.0%, respectively, for a three-year period.

BlackRock’s investments in technology, economies of scale, and low-cost offerings have helped it garner strong valuations and assets. This trend is expected to continue in 2018 due to buoyant global equities and fund flows.