Which Silver Miners Offer Diversified Exposure to Commodities?

For investors considering silver stocks due to their leveraged exposure to silver prices, the higher the company’s revenues derived from silver, the better.

Nov. 20 2020, Updated 12:51 p.m. ET

Commodity exposure

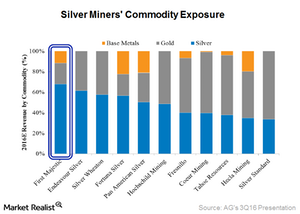

In the previous part of this series, we looked at miners’ geographic exposure—which is important to consider, given the geopolitical risks some jurisdictions face. It’s equally important to consider their revenue compositions in terms of commodity exposure.

Contribution from silver

Silver companies are rarely pure-play miners. For investors considering buying silver stocks due to their leveraged exposure to silver prices, the higher the company’s revenues derived from silver, the better.

Among the companies we’re considering for our discussion, First Majestic Silver (AG) derives the highest percentage of its revenues from silver versus other precious and base metals. In 3Q16, ~71% if its revenues came from silver sales. In contrast, Hecla Mining (HL) derives only 43% of its revenues from silver, 34% from gold, and the rest comes from the sale of lead and zinc.

Pan American Silver (PAAS) also derives the majority of its revenue from silver sales, at ~51%.

Diversifying into gold

Tahoe Resources (TAHO) is a primary silver producer. Its flagship mine, Escobal, is mainly a silver mine. With the acquisition of Lake Shore Gold, its weighing toward gold should increase. Tahoe also acquired the Shahuindo project through its acquisition of Rio Alto. This project increases the company’s exposure to gold. For 3Q16, Tahoe’s revenue contribution from gold was 57%, while from silver, it was 40%.

For investors looking to invest in silver miners, the Global X Silver Miners ETF (SIL) remains one of the leading options. The ProShares Ultra Silver fund (AGQ), on the other hand, provides leveraged exposure to changes in silver.