Reading the Volatility and RSI Levels for Miners

Precious metal mining stocks are known to closely track the performance of their respective precious metals. Mining stocks often show more volatility than metals.

Jan. 30 2017, Published 1:56 p.m. ET

Precious metal funds

Precious metal mining stocks are known to closely track the performance of their respective precious metals. Leveraged mining funds such as the Direxion Daily Gold Miners Bull 3X ETF (NUGT) and the Proshares Ultra Silver (AGQ) have risen 29.1% and 10.1%, respectively, YTD (year-to-date) as of January 26, 2017. Mining stocks often show more volatility than metals.

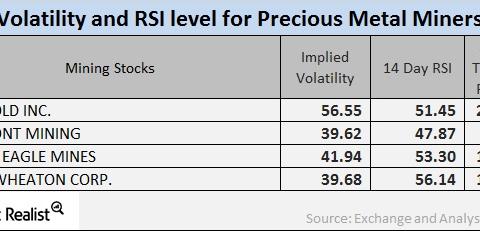

It’s important to monitor the implied volatilities of large mining stocks as well as their RSI (relative strength index) levels, particularly in the wake of the carnage among precious metal prices. Now let’s focus on New Gold (NGD), Newmont Mining (NEM), Agnico-Eagle Mines (AEM), and Silver Wheaton (SLW).

Implied volatility

Call implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option. During times of global and economic turbulence, volatility is higher than in a stagnant economy.

The volatilities of New Gold, Newmont Mining, Agnico-Eagle Mines, and Silver Wheaton were 56.6%, 39.6%, 41.9%, and 39.7%, respectively, on January 26, 2017. Silver Wheaton has the most volatility among these stocks and has seen a 30-day trailing gain.

RSI levels

RSI levels for each of these four mining giants rose due to their rising share prices. New Gold, Newmont Mining, Agnico-Eagle Mines, and Silver Wheaton had RSI levels of 51.5, 47.9, 53.3, and 56.1, respectively.

A 14-day RSI level of more than 70 indicates the possibility of a downward reversion in price. A level below 30 indicates the possibility of an upward reversion.