Inside BHP Billiton’s Recent Upgrades and Downgrades

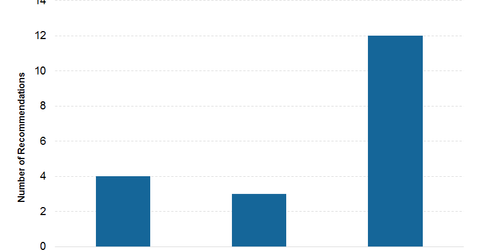

Of the 19 analysts covering BHP Billiton (BHP), four analysts issued “buy” recommendations, while 12 issued “holds,” and three issued “sells.”

Nov. 20 2020, Updated 2:37 p.m. ET

BHP’s consensus rating

Of the 19 analysts covering BHP Billiton (BHP), four analysts have issued “buy” recommendations, while 12 have “hold” recommendations, and three have issued “sell” recommendations on the stock. The consensus target price for the company is 25.8 Australian dollars (about $19.3), which implies a downside of 1%, as compared to its current market price.

Among other miners, Freeport-McMoRan (FCX), Southern Copper (SCCO), and Teck Resources (TCK) have been assigned mostly “hold” ratings by Wall Street analysts.

Barclays increased its target price for BHP from ~11.8 British pounds (about $14.4) to ~13.9 British pounds (about $17) on January 9, 2017. It has an “equal-weight” rating on the stock.

On January 6, 2017, JPMorgan Chase (JPM) reiterated its “sell” rating on the stock.

Upgrades and downgrades

Credit Suisse (CS) downgraded BHP from “neutral” to “underperform” on December 7, 2016. The firm shifted its preference to Rio from BHP in 2017. The broker downgraded the 12-month average iron ore price forecast to $45 per ton. This implied downgrades for BHP.

Citigroup (C), on the other hand, upgraded BHP’s stock from a “sell” to a “buy” rating on December 5, 2016. While Citi isn’t very bullish about the future prospects of iron ore, given the fundamental rebalancing needed, it has turned bullish in terms of its outlooks for other commodities.

Citi has also upgraded its iron ore price forecast by 21.6% for 2017 and by 58.8% for hard coking coal. Citi is positive on the outlooks for oil, copper, and zinc in 2017. To reflect its positive stance, it’s upgraded diversified miners such as BHP.

Changes in ratings

In the past year, the number of “buy” ratings for BHP has fallen 67%. BHP’s significant exposure to energy prices (USO) (UCO) through its Petroleum division may have caused some analysts to turn bearish on the stock. However, recently, OPEC’s (Organization of the Petroleum Exporting Countries) decision regarding production cuts boosted crude oil prices. The cut should be positive for crude oil’s outlook.

In the next part of this series, we’ll look at the consensus earnings estimates for BHP and explore the possibility of a revision in these estimates.