How Merck’s Business Segments Performed

Merck reported 3% growth in revenues to ~$10.4 billion during 4Q17 as compared to 4Q16.

March 30 2018, Updated 9:02 a.m. ET

Merck’s business segments

Merck’s (MRK) products are classified into four business segments: the human pharmaceutical segment, the animal health segment, healthcare services, and alliances. Merck reported 3% growth in revenues to ~$10.4 billion during 4Q17 as compared to 4Q16.

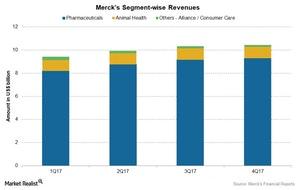

The above chart compares the quarterly revenues for Merck’s business segments during 2017.

Pharmaceutical segment

The pharmaceutical segment includes various products like acute care products, diabetes products, oncology products, and women’s health products. These products are the largest revenue contributors for Merck and contributed ~89% of total revenues during 4Q17. The pharmaceutical segment reported 4% growth in revenues to ~$9.3 billion during 4Q17 as compared to revenues of ~$8.9 billion during 4Q16. The growth in revenues included 3% growth in operating revenues and 1% growth due to the favorable impact of foreign exchange.

During 4Q17, the growth in the pharmaceutical segment was driven by the strong performance of drugs including Bridion, the Gardasil franchise, Keytruda, Januvia, Janumet, Pneumovax 23, Simponi, and Zepatier. However, the growth was partially offset by lower sales of other products like Zetia, Vytorin, and Isentress.

Animal health segment

The animal health segment includes drugs and vaccines for animals. The animal health segment reported 11% growth in revenues of $981 million during 4Q17 as compared to revenues of $884 million during 4Q16. The growth in revenues included 8% growth in operating revenues and 3% growth due to the favorable impact of foreign exchange.

For 4Q17, the growth was driven by increased sales of companion animal products including the Bravecto portfolio, companion animal vaccines, and the inclusion of Vallée SA.

The SPDR S&P Pharmaceuticals ETF (XPH) holds 4.2% of its total investments in Merck (MRK), 4.1% in Eli Lilly (LLY), 4.1% in Pfizer (PFE), and 4.1% in Johnson & Johnson (JNJ).