What Delta Air Lines’ Debt Position Means for Investors

During 1Q17, Delta Air Lines’ (DAL) debt rose by ~$2 billion at a blended interest rate of just 3.3%.

July 6 2017, Updated 10:36 a.m. ET

Debt increases

During 1Q17, Delta Air Lines’ (DAL) debt rose by ~$2 billion at a blended interest rate of just 3.3%. Delta raised this cash to pre-fund its pension obligations. During the quarter, Delta contributed $1.5 billion of the debt raised to the pension fund. It contributed another $0.35 billion in company stock and $0.75 billion in cash to the pension fund.

In April, Delta used the remaining debt proceeds of $0.5 billion and an additional $0.65 billion in cash to fund the pension plans. As a result of this pre-funding, Delta Air Lines can now reduce its pension fund contribution to $0.5 billion for 2018-2020 from the $1.2 billion planned earlier.

Peer comparison

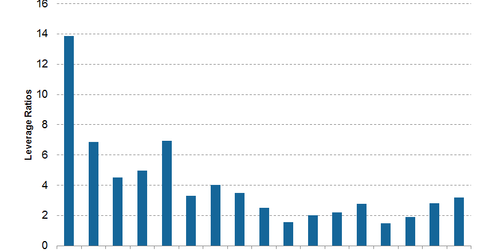

As expected, rising debt has increased DAL’s leverage ratio. DAL’s net-debt-to-EBITDA ratio has increased from 2.8x at the end of 4Q16 to 3.2x at the end of 1Q17.

At the end of 1Q17, American Airlines (AAL) had the highest leverage among airlines with a net-debt-to-EBITDA ratio of 14.8x, followed by United Continental (UAL) with a net-debt-to-EBITDA ratio of 9.3x. Alaska Air (ALK) had a net-debt-to-EBITDA ratio of 4.3x, Spirit Airlines (SAVE) of 1.8x, and JetBlue Airways (JBLU) of 1.4x. Southwest Airlines (LUV) was the only airline having more cash than debt on its balance sheet.

Outlook

Delta’s net debt has risen too. However, it continues to target net debt reduction of $4 billion by the end of 2020. Its strong cash flow from operations could help it achieve this target. In 1Q17, Delta managed to generate adjusted cash flow from operations of $0.7 billion excluding the $1.5 billion it contributed to the pension fund.

Investors can get exposure to Delta Air Lines stock by investing in the First Trust Nasdaq Transportation ETF (FXR), which invests 4.2% of its portfolio in the airline. Continue to the next article to know more about Delta Air Lines’ dividend payout.