How Will Rise in Crude Oil Inventories Affect Crude Oil Movement?

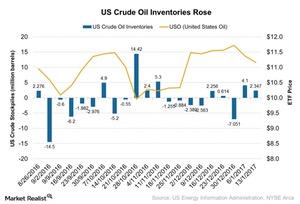

According to the EIA’s (US Energy Information Administration) report on January 18, 2017, US crude oil inventories rose ~2.35 MMbbls (million barrels) for the week ended January 13, 2017.

Jan. 24 2017, Published 9:34 a.m. ET

US crude oil inventories

According to the EIA’s (US Energy Information Administration) report on January 18, 2017, US crude oil inventories rose ~2.35 MMbbls (million barrels) for the week ended January 13, 2017. However, the markets expected a decline of ~0.34 MMbbls. In the previous week, inventories rose 4.1 MMbbls.

On January 18, 2017, after the crude oil inventories report came out, the United States Oil ETF (USO) fell 0.4%, and the ProShares Ultra Bloomberg Crude Oil (UCO) fell 0.8%. Crude oil prices (UWTIF) (BNO) react positively to a fall in inventory levels. A rise in inventories indicates that the supply glut position is increasing, which adds more uncertainty to the movement of crude oil prices.

Weaker demand in China

Demand fell in China (FXI) (YINN), the second-largest oil consumer in the world (ACWI) (VTI). The country has already sent major shocks to the global economy due to the fall in its economic performance.

Last week saw a little fluctuation in the performance of various macro products. Overall, performance was flat in the last week ahead of Donald Trump’s inauguration. Trump swore in as the 45th president of the United States (QQQ) (SPY) on January 20, 2017. The broad market (SPY) has risen 0.17% and the USO ETF has risen 0.16% in the last week.

In the next part of this series, we’ll analyze the performance of the US consumer price index in December 2016.