Will a Partnership with GE Improve BHI’s Returns?

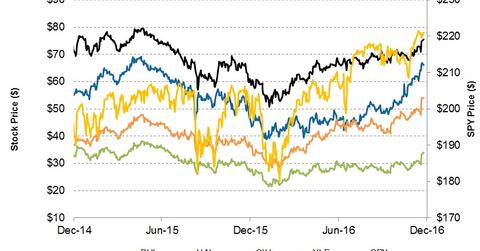

Between December 2014 and December 2016, Baker Hughes (BHI) stock hit its peak in April 2015. It troughed at ~$39 in January 2016.

Dec. 4 2020, Updated 10:53 a.m. ET

Stock returns for Baker Hughes

OFS stocks versus the market

Between December 2014 and December 2016, Halliburton (HAL) stock increased 43%. In the past two years, returns from the VanEck Vectors Oil Services ETF (OIH) have only reached 2%. OIH is an ETF tracking an index of 25 oilfield equipment and services (or OFS) companies.

From December 2014 to December 2016, the SPDR S&P 500 ETF (SPY) has increased. During this period, SPY has risen 14%. In the past two years, the Energy Select Sector SPDR ETF (XLE) was at its highest in April 2015. Currently, XLE’s price is only down 4% from that price. The energy equipment and services industry makes up 17.5% of XLE. In the past two years, Weatherford International (WFT) stock has fallen 51%.

Why OFS stock prices moved

In the past two years, Baker Hughes (BHI) has significantly outperformed the industry. BHI’s larger market cap peer Halliburton (HAL) also outperformed the industry ETF. The merger termination with Baker Hughes catapulted Halliburton stock in 2016. You can read more on this matter in Baker Hughes–Halliburton Merger Falls Through: Impact on BHI.

Many of the oilfield equipment and services (or OFS) stocks had reached a high in mid-2014 and then fell. Crude oil prices also peaked in June 2014 and then pulled back.

In 2016, as crude oil prices made a recovery, so did most of the OFS stocks. Baker Hughes’s pending merger with GE’s Oil and Gas business, as well as its proposed formation of a new company with Goldman Sachs (GS) and CSL Capital Management, has kept investors interested.

However, offshore project concerns and lower prices for Baker Hughes’s products and services in a number of international geographies can be a concern for BHI. Previously in this series, we discussed the potential implications of BHI’s partnership with GE (GE).