What’s the Outlook for Extra Space Storage?

Extra Space Storage’s (EXR) revenue grew 27% and 13% in 2016 and 9M17, respectively.

Jan. 15 2018, Updated 10:31 a.m. ET

What drove revenue growth for Extra Space Storage?

Extra Space Storage’s (EXR) revenue grew 27% and 13% in 2016 and 9M17, respectively. Property rental, tenant reinsurance, management fees, and other income drove growth in 2016. Property rental revenue rose 28% and 13% in 2016 and 9M17, respectively. Every segment drove growth in 9M17, offset by management fees and other income.

A look at EPS

Extra Space Storage’s gross profit grew 28% and 14% in 2016 and 9M17, respectively. Operating expenses increased 2% in 2016 before decreasing 1% in 9M17. As a result, operating income and adjusted operating income grew 53% and 23% in 2016 and 9M17, respectively.

Other income offset the impact of rising interest expenses in 2016, unlike 9M17. Adjusted net income rose 93% in 2016 before falling 7% in 9M17. Adjusted diluted EPS (earnings per share) rose 87% in 2016 before falling 8% in 9M17.

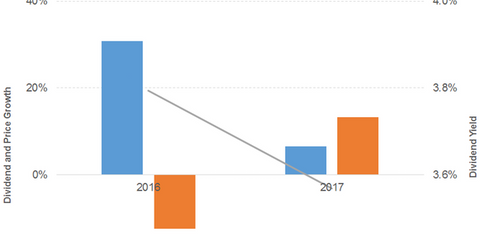

Dividend and price growth

EXR’s dividend per share grew 31% and 6% in 2016 and 2017, respectively. Prices fell 12% in 2016 before rising 13% in 2017. That led to a downward sloping dividend yield curve. A forward PE (price-to-earnings) ratio of 31.1x and a dividend yield of 3.6% compare to a negative sector average forward PE ratio of 34.3x and a dividend yield of 4.3%.

How does EXR compare to the broader indexes?

The S&P 500 (SPX-INDEX) (SPY) offers a dividend yield of 2.2%, a PE ratio of 23.4x, and a YTD (year-to-date) return of 19.6%. The Dow Jones Industrial Average (DJIA-INDEX) (DIA) has a dividend yield of 2.2%, a PE ratio of 22.3x, and a YTD return of 25.1%. The NASDAQ Composite (COMP-INDEX) (ONEQ) has a PE ratio of 28.2x and a YTD return of 24.8%.

What’s the revenue and EPS outlook?

Extra Space Storage’s property rental revenue is being projected to have an 11% and 6% growth in 2017 and 2018, respectively. Its diluted EPS is being projected to fall 4% in 2017 before rising 3% in 2018.