Extra Space Storage Inc

Latest Extra Space Storage Inc News and Updates

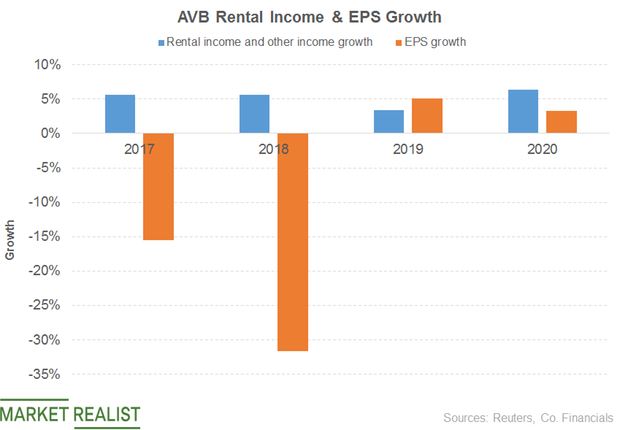

AvalonBay: What’s Driving the Dividend and Valuations?

AvalonBay’s revenue grew 7% in the first quarter, driven by rental and other income.

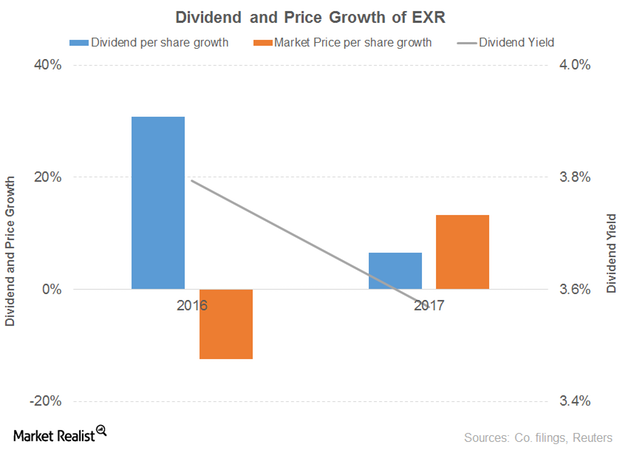

What’s the Outlook for Extra Space Storage?

Extra Space Storage’s (EXR) revenue grew 27% and 13% in 2016 and 9M17, respectively.

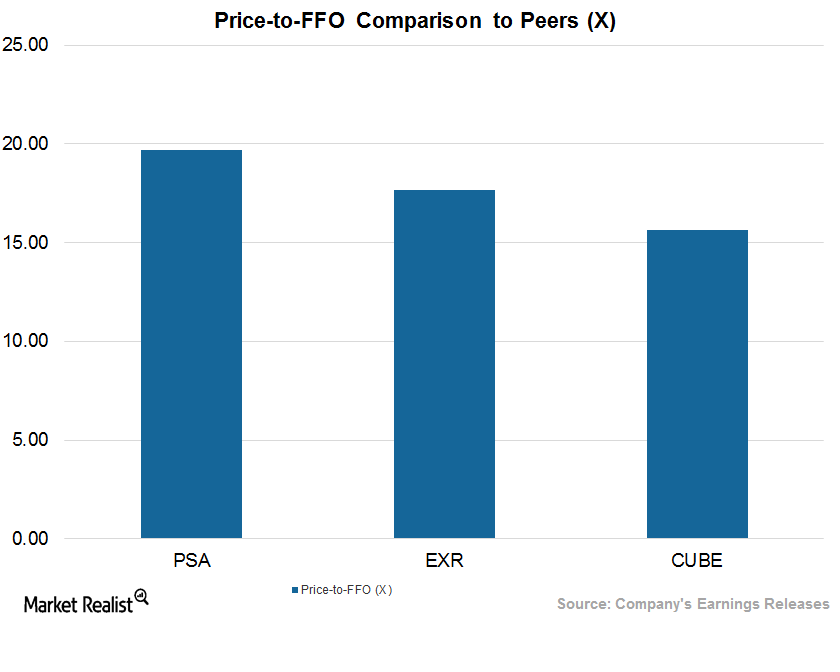

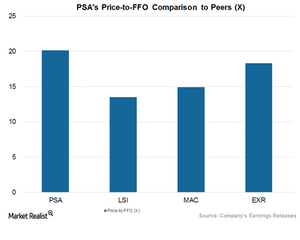

Comparing the Valuations of 3 Leading Self-Storage REITs after 2Q17

Public Storage (PSA) trades at an EV-to-EBITDA multiple of ~21.5x.

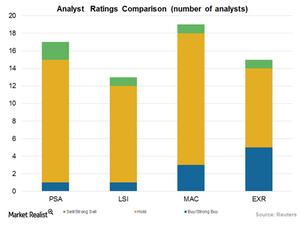

How Analysts View Public Storage

Analysts have assigned PSA a mean price target of $217.67, which is 4.9% higher than its current price level.

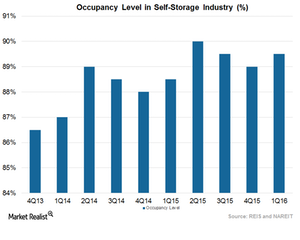

Where Public Storage Stands among Other Major Players

Public Storage has consistently been able to return capital value as well as shareholder returns in the form of dividends and share buybacks.

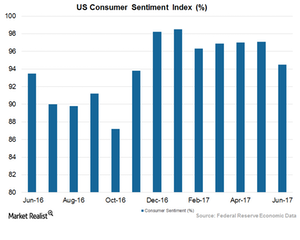

Public Storage and the Growing US Economy

Public Storage (PSA) is expected to witness a higher cost of debt in 2Q17, mainly due to the Fed’s rate hikes in 2017.

Inside Public Storage’s 2Q17 Battle with Macro Headwinds

Public Storage (PSA) is expected to post flat top-line and bottom-line results in 2Q17.

What’s Really Driving Public Storage’s Expected 2Q17 Upbeat Results

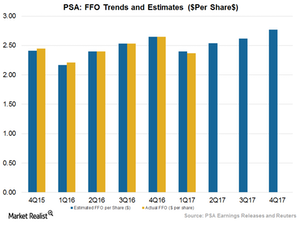

Wall Street expects PSA to report adjusted FFO (funds from operation) of $2.40, compared with $2.54 in 2Q16.

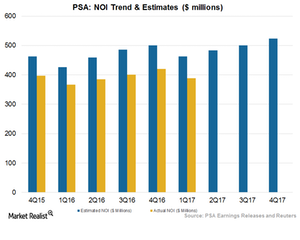

Will Public Storage’s Cost-Reduction Initiatives Drive Higher NOI in 2Q17?

Wall Street analysts expect Public Storage (PSA) to report NOI (net operating income) of $483.7 million for 2Q17.

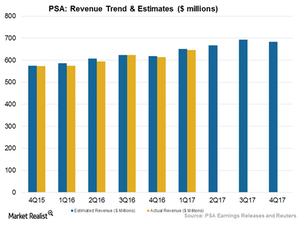

Will Public Storage Ride High on Top Line in 2Q17?

Wall Street expects Public Storage (PSA) to report revenue of $667.9 million for 2Q17. Its earnings call will be on July 27, 2017.

What Lies Ahead for Public Storage in 2Q17

Analysts expect PSA to report adjusted FFO (funds from operation) of $2.40, compared with $2.54 in 2Q16.