The Competitive Landscape for Enbrel

Amgen (AMGN) launched Enbrel in the US in 1998. It became a major success for Amgen in no time and recorded $5.4 billion sales in 2015.

Dec. 29 2016, Updated 9:06 a.m. ET

Enbrel has been on the market since 1998

Amgen (AMGN) launched Enbrel in the US in 1998. It became a major success for Amgen in no time and recorded $5.4 billion sales in 2015. Amgen co-promotes the drug with Pfizer (PFE). Pfizer holds the rights to sell and market Enbrel outside the US and Canada.

Enbrel inhibits the tumor necrosis factor (or TNF) and currently is approved for treating moderate-to-severe active rheumatoid arthritis, chronic moderate-to-severe plaque psoriasis, and active psoriatic arthritis.

Enbrel for use in pediatric patients

On November 4, Enbrel was approved for treating children between the ages of 4–17 with chronic moderate-to-severe plaque psoriasis. Thus, Enbrel became the first and only systematic therapy for treating chronic pediatric psoriasis cases.

About 125 million people around the world suffer from psoriasis, and about one-third of this population is pediatric. This expanded label should help Enbrel to sustain its market share.

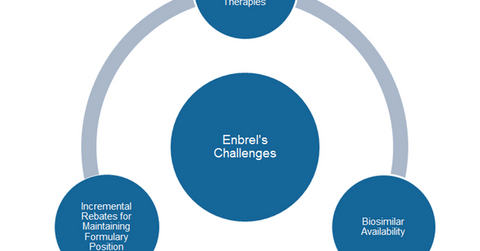

Enbrel faces fierce competition

Enbrel faces strong competition from AbbVie’s (ABBV) Humira, and Johnson & Johnson’s (JNJ) Remicade. With such intense competition, Amgen might need to offer incremental rebates to PBMs (pharmacy benefit managers) to maintain the formulary position of the drug.

Considering the fierce competition, biosimilar availability and possibly incremental rebates, Enbrel could see a tougher period beyond 2016. We’ll discuss the biosimilar threat to Enbrel in the next article.

Perhaps the competition that Enbrel faces is the reason for Amgen’s discounted valuation. If Enbrel’s sales fell at a greater pace than anticipated, Amgen’s share price might further drop. The iShares U.S. Healthcare ETF (IYH) can give you exposure to Amgen at reduced risk. IYH invests 4% of its assets in Amgen’s stock.