China’s Trade Data and the Weaker Dollar Support Commodities

Copper prices are stable in the early hours on December 8. China’s upbeat trade balance data are supporting the sentiment in the copper market.

Dec. 8 2016, Published 9:21 a.m. ET

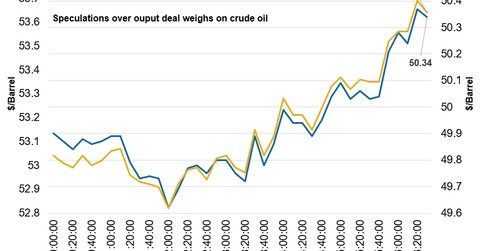

Crude oil

Crude oil prices are stable around $50 amid speculations about the output cut deal. Doubts about whether the proposed output cuts are sufficient to balance the market are weighing on the sentiment. At 6:15 AM EST on December 8, the West Texas Intermediate crude oil futures contract for January 2017 delivery was trading at $50.38 per barrel—a rise of ~1.3%. The Brent crude futures contract for February 2017 delivery rose ~1.4% to $53.73 per barrel.

In producers’ meeting on November 30, OPEC agreed to cut production to 32.5 MMbpd (million barrels per day) from 33.7 MMbpd. Non-OPEC producers agreed to cut production by 600,000 bpd (barrels per day). Russia, which is a non-OPEC producer, agreed to gradually decrease its production by 300,000 bpd in 2017. OPEC and non-OPEC producers are meeting again this weekend to discuss the details of output cut deal. The PowerShares Dynamic Energy Exploration & Production Portfolio (PXE) and the SPDR S&P Oil & Gas Exploration & Production (XOP) rose 0.17% and 0.4% on December 7.

Copper

After falling for two consecutive trading days, copper prices are stable in the early hours on December 8. China’s upbeat trade balance data are supporting the sentiment in the copper market. According to trade balance data, Chinese imports rose 6.7% in November, while exports rose 0.1%. The weaker US dollar also supported copper. The weaker dollar supports the prices of dollar-denominated commodities such as crude oil and copper. The PowerShares DB Base Metals (DBB) fell 1.4%, while the SPDR S&P Metals & Mining (XME) rose 1.3% on December 7.

Precious metals

In the early hours on December 8, gold (GLD) is flat and silver is weaker despite the weaker dollar. At 6:30 AM EST on December 8, the COMEX gold futures contract for February 2017 delivery was trading at $1,178 per ounce—a gain of ~0.04%. The silver futures contract for March 2017 delivery fell ~0.47% to $17.19 per ounce. China’s better-than-expected trade data extended support to gold. The chances of an interest rate hike by the Fed in the near term increased amid supporting US economic data. It dented the sentiment in the gold market. The platinum futures contract for January 2017 delivery was trading at $951.20 per ounce—a gain of ~0.85%. After touching fresh 2016 highs last week, palladium pulled back this week. At 6:30 AM EST, the palladium futures contract for March 2017 delivery was trading at $725.15 per ounce—a fall of ~1.0%.