Wells Fargo Downgrades Greif to ‘Market Perform’

Greif (GEF) has a market cap of $2.9 billion. It fell 3.2% to close at $54.02 per share on November 21, 2016.

Nov. 22 2016, Updated 3:04 p.m. ET

Price movement

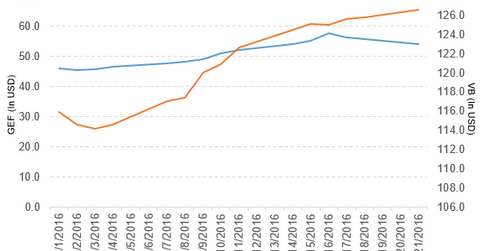

Greif (GEF) has a market cap of $2.9 billion. It fell 3.2% to close at $54.02 per share on November 21, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -0.06%, 13.0%, and 81.6%, respectively, on the day.

GEF is trading 8.6% above its 20-day moving average, 10.9% above its 50-day moving average, and 40.6% above its 200-day moving average.

Related ETF and peers

The Vanguard Small-Cap ETF (VB) invests 0.03% of its holdings in Greif. The YTD price movement of VB was 15.6% on November 21.

The market caps of Greif’s competitors are as follows:

Greif’s rating

On November 21, 2016, Wells Fargo downgraded Greif’s rating to a “market perform” from an “outperform.”

Performance of Greif in 3Q16

Greif reported 3Q16 net sales of $845.0 million, a fall of 9.1% compared to its net sales of $930.0 million in 3Q15. Net sales from the company’s Rigid Industrial Packaging & Services, Paper Packaging & Services, and Flexible Products & Services segments fell 10.8%, 2.4%, and 11.7%, respectively, and sales from its Land Management segment rose 13.7% in 3Q16 compared to 3Q15.

The net income and EPS (earnings per share) of Greif’s Class A stock and the EPS of Greif’s Class B stock rose to $46.1 million, $0.78, and $1.18, respectively, in 3Q16, compared to $8.6 million, $0.15, and $0.22, respectively, in 3Q15. The company reported consolidated EBITDA (earnings before interest, tax, depreciation, and amortization) of $101.2 million in 3Q16, a rise of 29.7% compared to 3Q15.

GEF’s cash and cash equivalents and inventories fell 11.2% and 2.9%, respectively, in 3Q16, compared to 4Q15.

Projections

The company has made the following projections for 2016:

- Class A EPS before special items in the range of $2.36–$2.56

- capital expenditure in the range of $95 million–$110 million

- free cash flow in the range of $160 million–$190 million

- restructuring expenses in the range of $20 million–$30 million

- tax rate in the range of 35%–38%

Now, let’s take a look at Apple (AAPL).