Greif Inc

Latest Greif Inc News and Updates

How Did Greif Perform in Fiscal 4Q16?

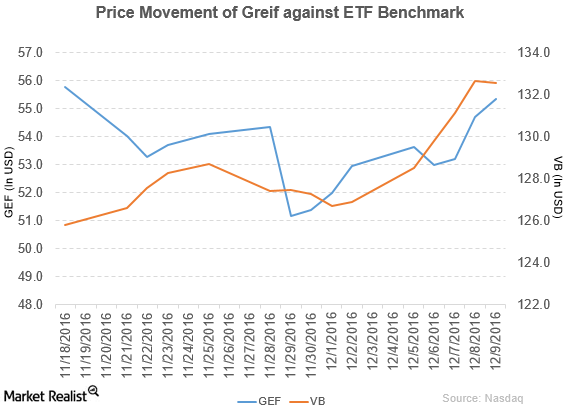

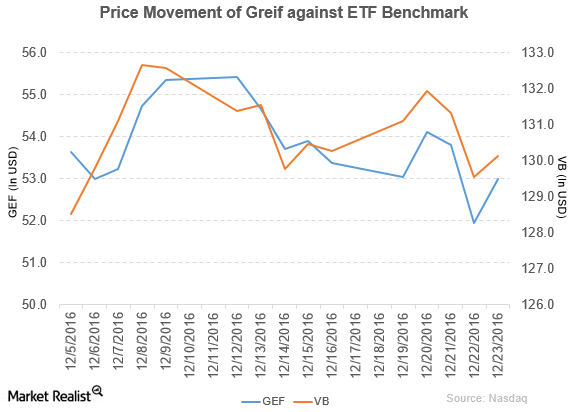

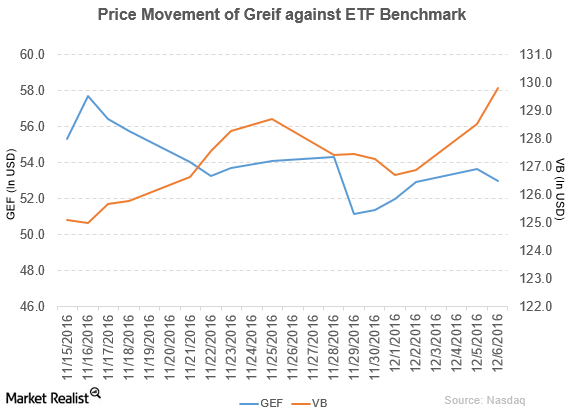

Greif (GEF) rose 4.6% to close at $55.35 per share during the first week of December 2016.

Bank of America/Merrill Lynch Upgrades Greif to a ‘Buy’

In fiscal 2016, Greif (GEF) reported net sales of $3.3 billion, a fall of 8.1% year-over-year.

Robert W. Baird Upgrades Greif to ‘Outperform’

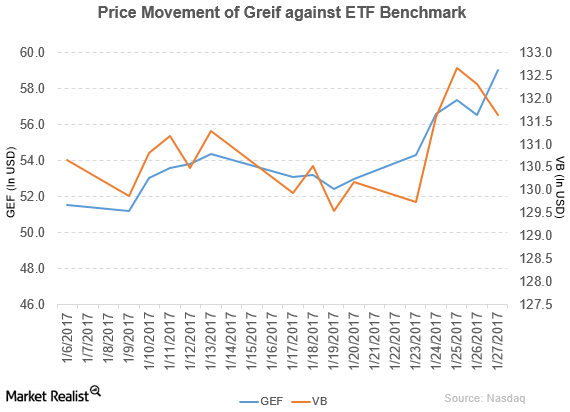

Greif (GEF) has a market cap of $3.0 billion. It rose 3.5% to close at $53.80 per share on January 4, 2017.

BMO Capital Downgrades Greif to ‘Underperform’

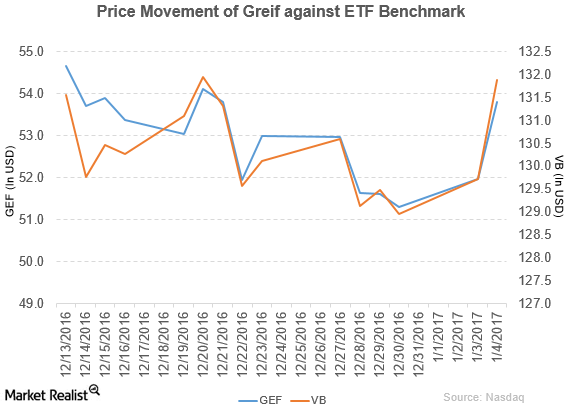

Greif (GEF) fell 0.69% to close at $53 per share during the third week of December 2016.

Greif Declared Quarterly Dividends

Greif (GEF) has a market cap of $2.8 billion. It fell 1.2% to close at $52.98 per share on December 6, 2016.

Berenberg Rated Delphi Automotive as a ‘Hold’

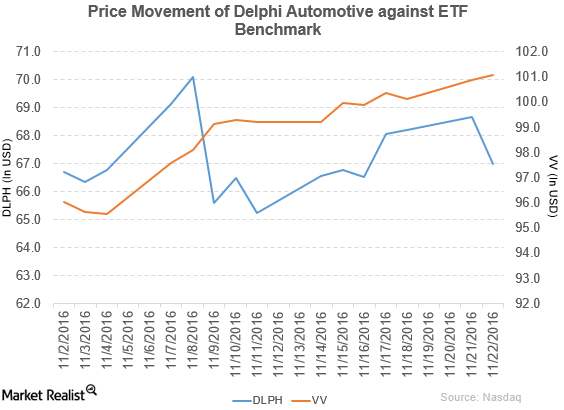

Delphi Automotive (DLPH) has a market cap of $18.1 billion. It fell 2.5% to close at $66.98 per share on November 22, 2016.

Bank of America/Merrill Lynch Downgrades Greif to ‘Neutral’

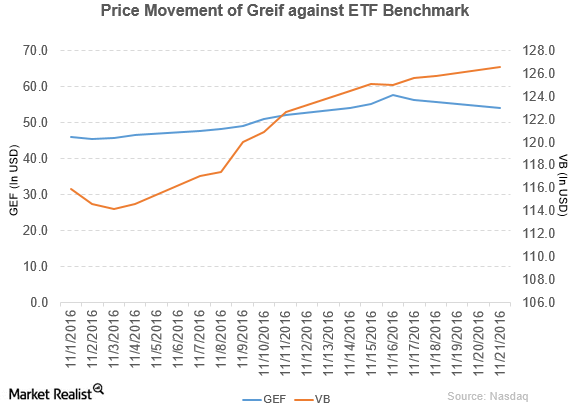

Greif reported 3Q16 net sales of $845.0 million, a fall of 9.1% compared to its net sales of $930.0 million in 3Q15.

Wells Fargo Downgrades Greif to ‘Market Perform’

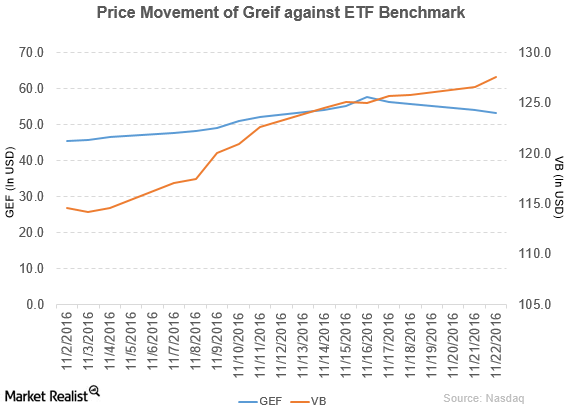

Greif (GEF) has a market cap of $2.9 billion. It fell 3.2% to close at $54.02 per share on November 21, 2016.

Moody’s Upgrades Johnson Controls’ Senior Unsecured Rating

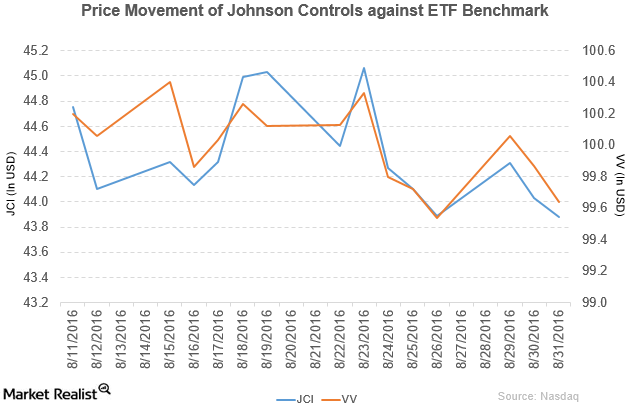

Johnson Controls (JCI) has a market cap of $28.1 billion. It fell by 0.34% to close at $43.88 per share on August 31, 2016.