Why Did Sanchez’s Stock Rise after 3Q16 Earnings Release?

After Sanchez Energy’s (SN) 3Q16 earnings release on November 7, its stock rose ~2%.

Dec. 4 2020, Updated 10:53 a.m. ET

Sanchez’s stock performance

After Sanchez Energy’s (SN) 3Q16 earnings release on November 7, its stock rose ~2%. YoY (year-over-year), SN has risen 1.9%. In this part of our series, we’ll analyze Sanchez’s stock performance with respect to movements in the broader industry and the broader market.

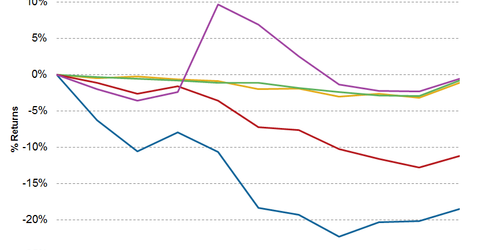

As the graph above shows, Sanchez Energy’s performance has been driven mainly by WTI (West Texas Intermediate) crude oil prices (OIL) and natural gas prices (UNG). These have also been driving the broader industry ETF, the Energy Select Sector SPDR ETF (XLE).

From October 24 to November 7, Sanchez’s stock was underperforming the Energy Select Sector SPDR ETF (XLE). Toward the end of the period, it gave lower returns compared to XLE. SN’s stock fell ~18.5% during this period, while XLE fell ~1.1%.

Sanchez’s stock also gave lower returns compared to crude oil at the end of the period, and it also underperformed the SPDR S&P 500 ETF (SPY), which decreased by only 0.07% in the two-week period. SN’s stock rose ~2% on November 7 on the back of its better-than-expected 2Q16 earnings. A 1.8% increase in crude oil prices on November 7 also likely boosted SN’s stock.

Next, let’s discuss Sanchez’s implied volatility.